Most people don't know that they can save $1,000s in crypto tax at the touch of a button by using auto tax loss harvesting.

That's where crypto tax software comes in, the best software seamlessly connects to all of your wallets and crypto exchanges, and generate real-time crypto tax reports in minutes, no matter what country you are in.

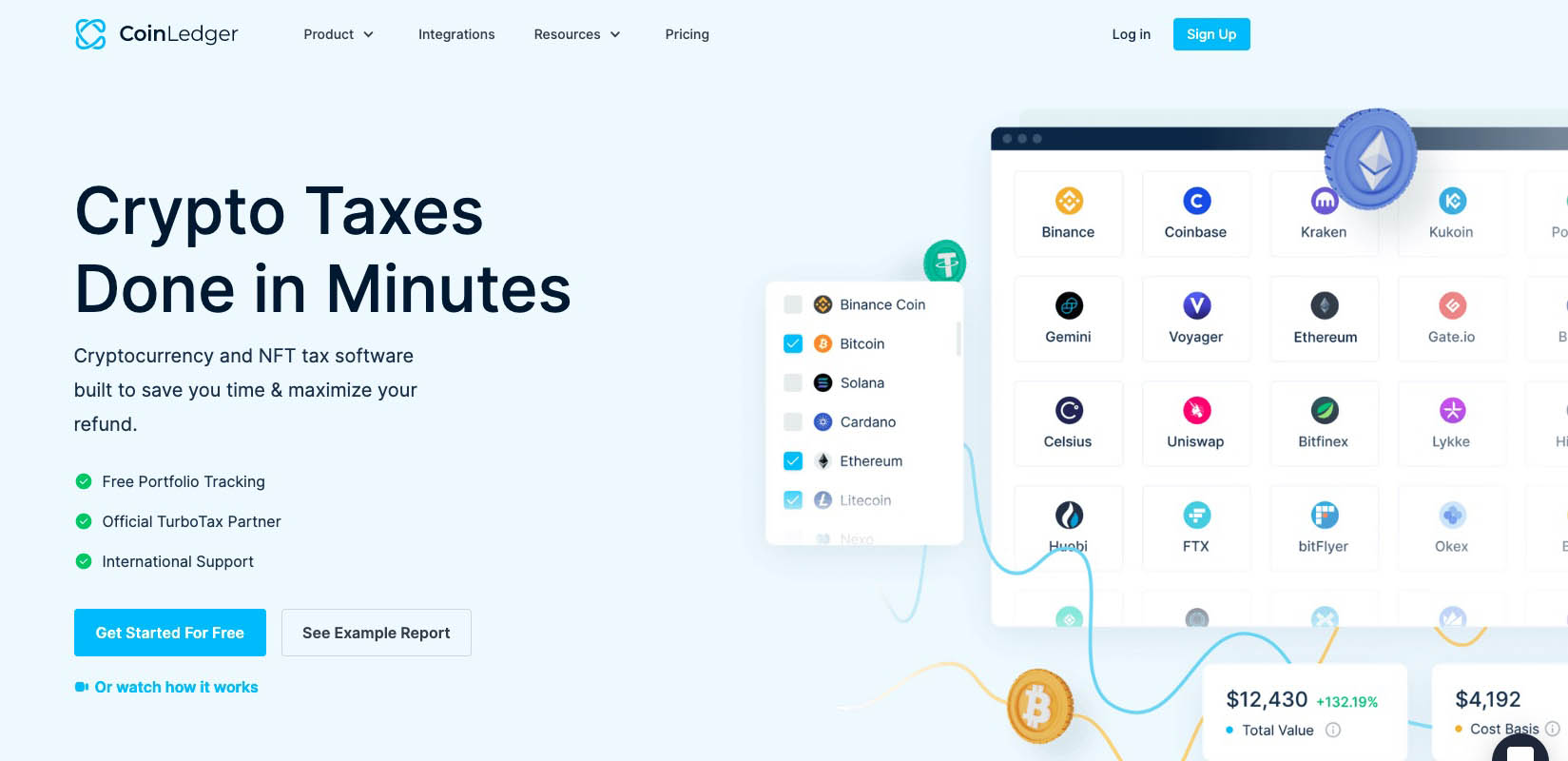

Want to get right to the best crypto tax software right now? Our favourite choice is CoinLedger, it is just 2x better than the other options out there.

When picking the best crypto tax software, there are hundreds of different choices to compare.

And all provide different levels of features, performance, ease of use, and price ranges – not to mention different discounts and savings at checkout.

Here are our picks for the best crypto tax software:

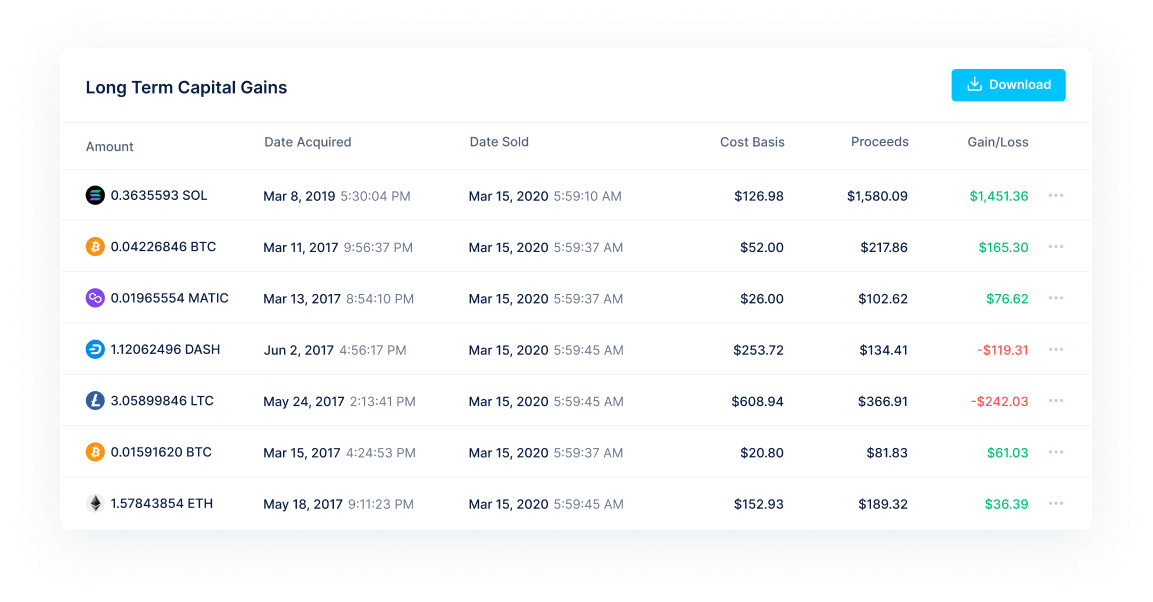

CoinLedger (CryptoTrader.Tax)

CoinLedger is the most popular crypto tax software platform, and it's really easy to see why.

It offers a pretty much every feature you need to make it effortless to file your crypto taxes, we're talking:

- Automated synchronisation with unlimited crypto exchanges

- Real-time profit and loss reports

- Portfolio tracking

- Tax loss harvesting

CoinLedger also offers a free plan for those who need basic tax compliance. If you need more advanced features, you can sign up for a paid plan.

Hands down CoinLedger is our favourite crypto tax software, it's really easy to use and in just 5 minutes it gives you free tax report preview.

Best For: Best All-Round Software for All Crypto Traders

CoinLedger is the best all round crypto tax software available at the moment. It ticks all the boxes in terms of features, pricing and ease of use.

Main CoinLedger (CryptoTrader.Tax) Features

- Auto data sync - All your data is automatically synced from all exchanges and wallets that you connect to CoinLedger, so you don't have to waste time manually importing anything!

- International support - CoinLedger supports virtually every fiat currency around the world

- Auto tax harvesting - Easy to use tax harvesting rules to minimise the amount of tax you pay

- Syncs with your non-crypto tax software - Whether you use QuickBooks, Xero or FreshBooks you can easily sync CoinLedger with your main accounting software

CoinLedger (CryptoTrader.Tax) Demo Video

CoinLedger (CryptoTrader.Tax) Pricing

CoinLedger has a 14 day free trial on all of it's packages, so it's definitely worth giving it a try to see if you like it. You can sign up for the free trial here: CoinLedger Free Trial

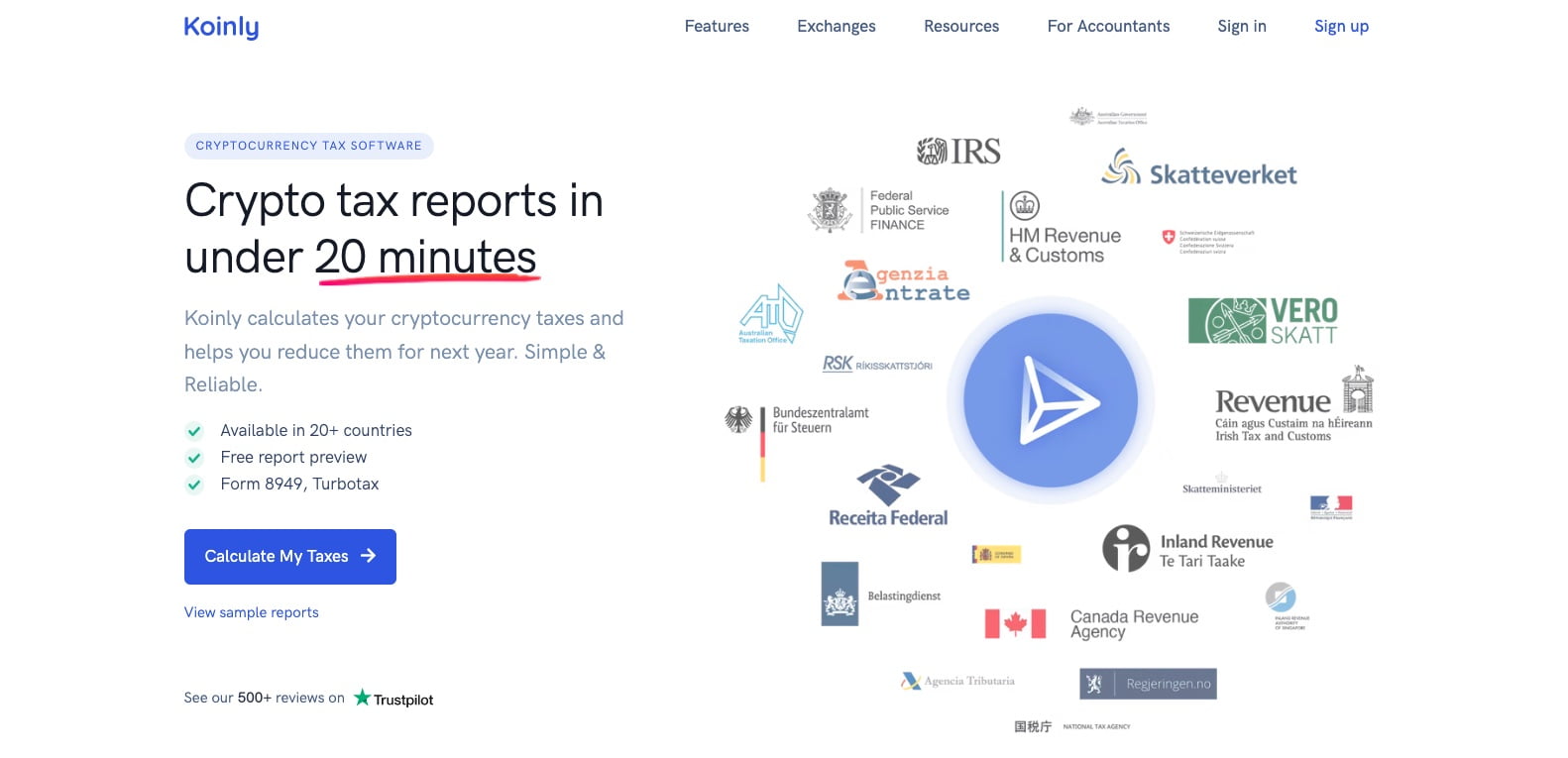

Koinly

Why We Love Koinly

Koinly is another great piece of crypto software, in just about 20 minutes Koinly calculates your crypto tax no matter what country you're in. It actually took us less than 15 minutes. But hey, no one is counting right?

Best For: International Traders

Koinly is the best for international tax reporting.

Main Koinly Features

- Great exchange support - You can connect to over 350 crypto exchanges, 70+ crypto wallets and more than 14 blockchain addresses

- Auto sync - All your data is automatically synced from all exchanges and wallets that you connect to Koinly. Manual work is truly so suckers.

- Sync with your non-crypto tax software - Whether you use QuickBooks, Xero or FreshBooks you can sync Koinly with your main accounting software

- Real-time reports - You can see your profit, loss and tax liabilities in real-time using Koinly…hopefully just profits, scrap the losses.

Koinly Pricing

If you're thinking of giving Koinly a go, the team have a free plan that gives you access to all of the essential features. You can sign up for the free trial here: Koinly Free Trial

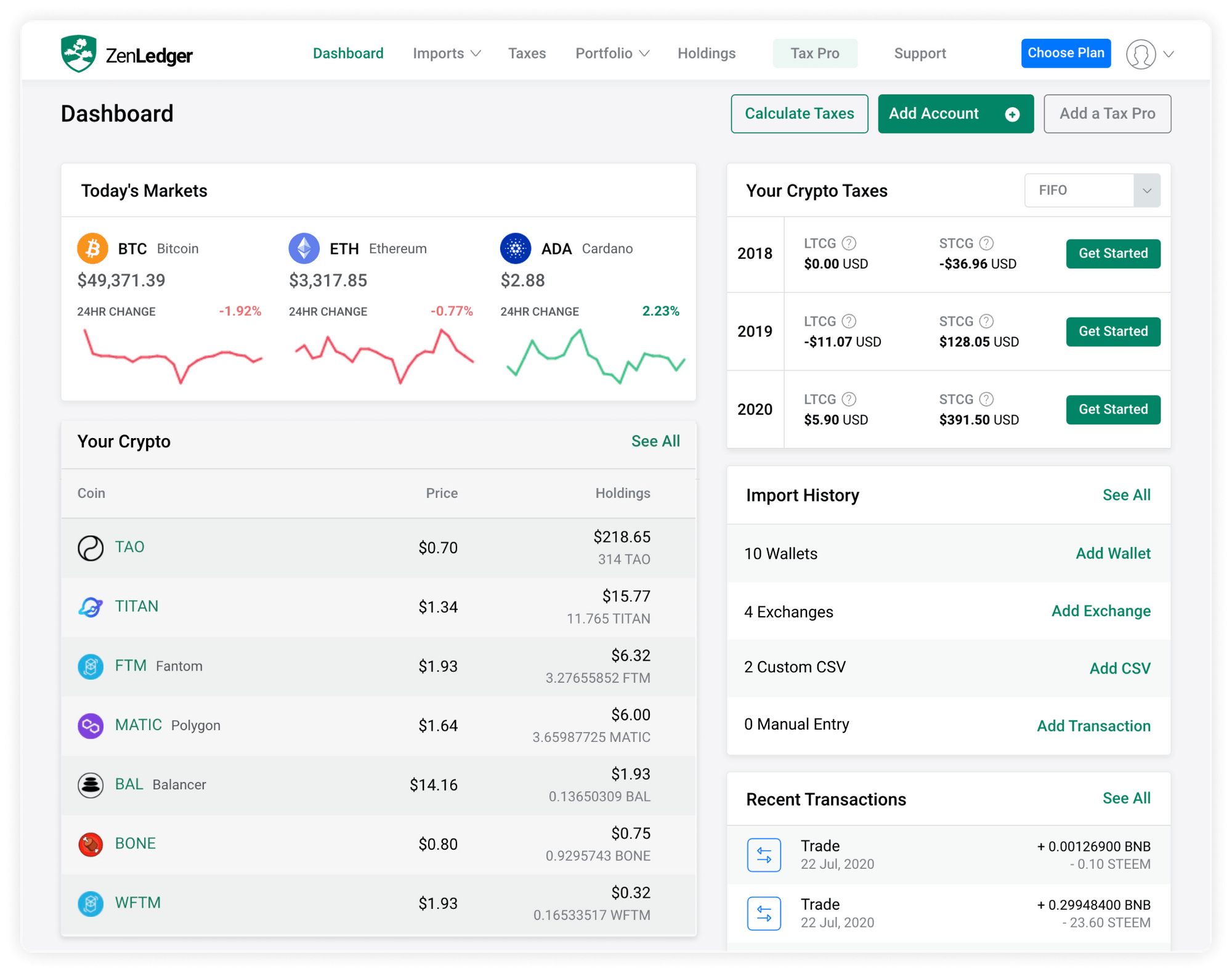

ZenLedger

ZenLedger is the best cryptocurrency tax software because it is the most user-friendly. The interface is very intuitive and easy to use. You can connect your exchanges and wallets in a matter of minutes. ZenLedger also supports a wide range of digital assets, so you can be sure that all your crypto investments are accounted for.

ZenLedger also offers a powerful tax loss harvesting feature. This lets you automatically sell your losing positions at a loss to offset any gains you've made elsewhere. This is an incredibly valuable tool for anyone looking to minimize their tax bill.

In addition to being user-friendly and offering tax loss harvesting, ZenLedger also has a number of other useful features. For example, it allows you to generate detailed reports of your crypto activity. This is incredibly helpful come tax time.

ZenLedger also has an audit trail feature. This allows you to track your crypto transactions and ensure that everything is accounted for. This is an invaluable tool for anyone who wants to make sure their taxes are done correctly.

Finally, ZenLedger offers customer support. This is a huge benefit if you have any questions or run into any problems. The team is very responsive and always happy to help.

If you're looking for the best cryptocurrency tax software, then ZenLedger is the right choice for you. It's user-friendly, offers powerful features like tax loss harvesting, and has excellent customer support. If you're serious about minimizing your taxes, then ZenLedger is the right choice for you.

Main ZenLedger Features

Let's take a look at some of the key features ZenLedger offers.

ZenLedger is one of the most popular crypto tax software programs available. And there's good reason for that. Here are just some of the things that make ZenLedger so popular among crypto investors and traders:

- Support for over 3500 different types of cryptocurrency transactions. This includes all major coins like Bitcoin, Ethereum, Litecoin, and so on, as well as a wide variety of altcoins.

- Automatic import of transaction data from popular exchanges like Coinbase, Binance, Kraken, and others. This makes it really easy to get started with ZenLedger, as you don't have to manually input all your transaction data.

- A user-friendly interface that makes it easy to view your tax liability, create tax reports, and more.

- Detailed tutorial videos that walk you through every step of the process, from setting up your account to filing your taxes.

These are just some of the reasons why ZenLedger is one of the most popular crypto tax software programs available. If you're looking for a comprehensive solution for your crypto tax needs, ZenLedger is definitely worth checking out.

ZenLedger Pricing

The pricing for ZenLedger is very simple. We charge a flat rate of $25 per month, and there are no hidden fees or commissions. This flat rate gives you access to all of our features and tools, including tax loss harvesting.

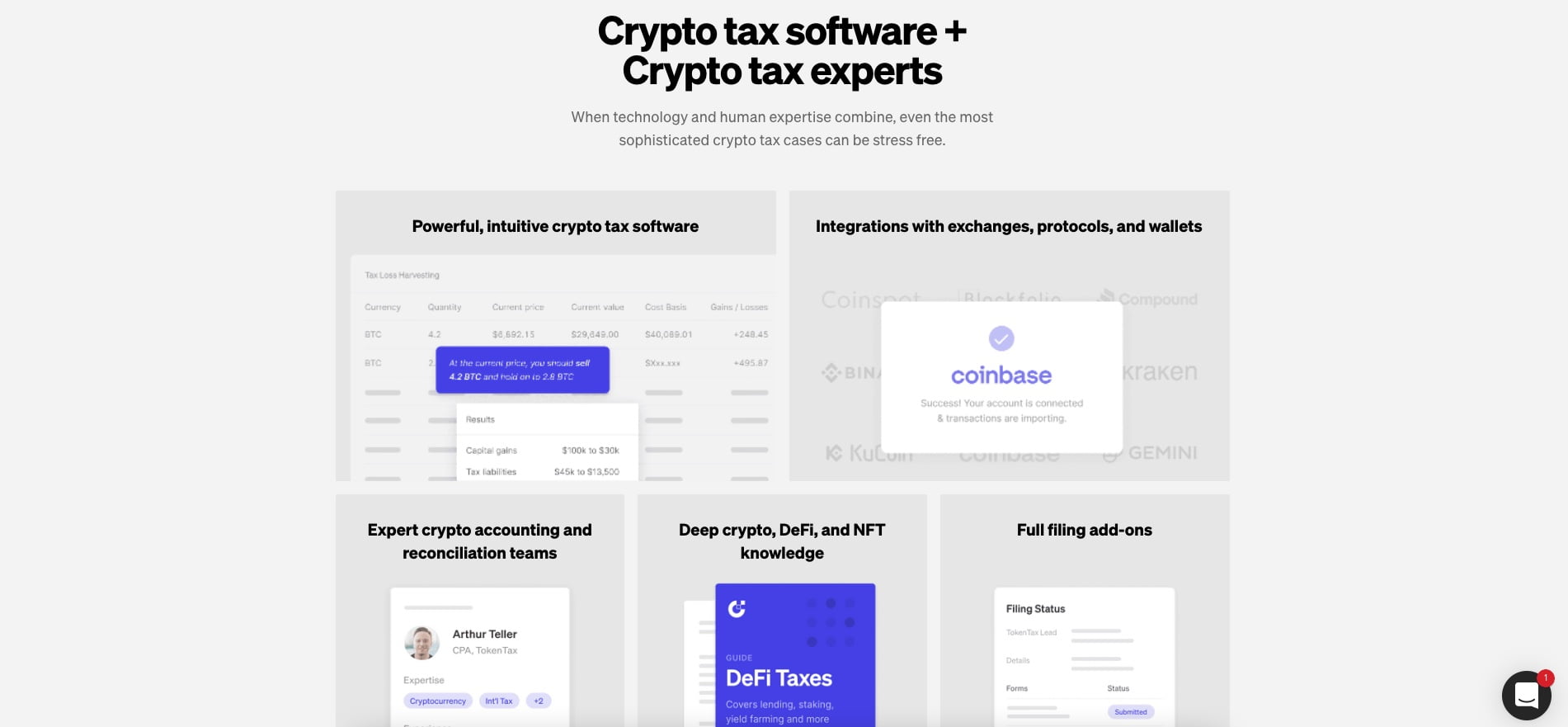

TokenTax

Why We Love TokenTax

If you’ve got a complicated crypto investing setup, TokenTax is perfect for you. It has a host of automation features that make your life just that little bit easier.

Best For: Complex Accounts

TokenTax is best for people with complex crypto accounts and for business accounts

Main TokenTax Features

- Automatically connects to all crypto exchanges to seamlessly retrieve your data with no manual work needed

- TokenTax has the ability to calculate your crypto taxes and file with the IRS & HMRC

- Automated tax loss harvesting to ensure you only pay the minimum amount of taxes

- Supports virtually every crypto exchange

TokenTax Pricing

- Basic Plan: $65 per tax year

Best Crypto Tax Software Reviews: The Ultimate Guide to Crypto Tax Table of Contents

Summary of The Best Crypto Tax Software

Summary of The Best Crypto Tax Software

| Rank | Name | Best For | Link |

| 1 | CryptoTrader (CoinLedger) | Ease of use & integrations with all crypto exchanges | Visit Website |

| 2 | Koinly | Automatic data synchronisation | Visit Website |

| 3 | TokenTax | Simple integration | Visit Website |

| Rank | Name | Best For |

| 1 | CryptoTrader (CoinLedger) | Ease of use & integrations with all crypto exchanges |

| 2 | Koinly | Automatic data synchronisation |

| 3 | TokenTax | Simple integration |

Crypto Tax Frequently Asked Questions

Making life-changing money in crypto and wondering how to report your taxes? Don't worry, you are not alone. The crypto world is confusing enough without having to worry about tax implications too! In this blog post, we will walk you through everything you need to know about crypto tax for beginners. We will cover topics such as what crypto is taxed, what records you need to keep, and how to file your taxes. By the end of this post, you will be an expert on crypto tax!

What is Crypto Tax?

Crypto tax is a tax on crypto currency transactions. The most common type of crypto tax is capital gains tax, which is levied on the sale of crypto assets.

However, there are other types of crypto taxes that can be levied on crypto transactions, such as value-added tax (VAT) and goods and services tax (GST).

What Are the Different Types of Crypto Taxes?

The most common type of crypto tax is capital gains tax. This is atax that is levied on the sale of crypto assets.

Capital gains tax is calculated by subtracting the original purchase price from the sale price. If the result is positive, then it is considered a capital gain and taxed accordingly. If the result is negative, then it is considered a capital loss and can be used to offset other capital gains.

In addition to capital gains tax, there are other types of crypto taxes that can be levied on crypto transactions. These include value-added tax (VAT) and goods and services tax (GST).

How Is Crypto Tax Calculated?

Crypto tax is calculated by subtracting the original purchase price from the sale price. If the result is positive, then it is considered a capital gain and taxed accordingly. If the result is negative, then it is considered a capital loss and can be used to offset other capital gains.

What Are Some Tips for Minimizing Crypto Taxes?

There are a few things that you can do to minimize your crypto taxes.

First, you can try to time your crypto purchases and sales so that you have more short-term capital gains than long-term capital gains. Short-term capital gains are taxed at a lower rate than long-term capital gains.

Second, you can use crypto losses to offset other crypto gains. This can help reduce your overall tax liability.

Finally, you should keep track of all of your crypto transactions and document everything carefully. This will make it easier to calculate your taxes and ensure that you don't end up paying more tax than you owe.

How is Crypto Taxed in America?

In America, crypto is taxed as property. This means that if you buy crypto and it goes up in value, you owe capital gains tax on the increase in value when you sell it. If it goes down in value, you can write off the loss as a capital loss on your taxes.

The IRS has been fairly clear that crypto is taxable, but they have yet to issue guidance on how exactly to report it. For now, the best way to report crypto taxes is using software, you can find 3 of the best crypto software here. These platforms will help you calculate your gains and losses from trading crypto and generate the necessary tax reports.

What About Crypto Tax in Other Countries?

Outside of America, the situation is a bit more complicated. In some countries, crypto is treated as a commodity, while in others it is treated as currency. This can have a big impact on how crypto is taxed.

For example, in Australia, crypto is considered a commodity and is subject to capital gains tax. This means that if you buy crypto and it goes up in value, you owe capital gains tax on the increase in value when you sell it. However, if you hold your crypto for more than 12 months, you may be eligible for a 50% discount on your capital gains tax.

In Germany, crypto is considered a financial asset and is subject to both income tax and capital gains tax. This means that if you earn crypto from interest or dividends, you owe income tax on those earnings. And if you buy crypto and it goes up in value, you owe capital gains tax on the increase in value when you sell it.

The bottom line is that crypto taxes are complicated and vary from country to country. If you want to make sure you're complying with the law, your best bet is to use crypto tax software to make you life 10x easier

Do You Have to Pay Crypto Taxes?

The short answer is yes, you probably do have to pay crypto taxes. However, there are a few exceptions.

For example, if you use crypto as a payment method for goods or services, you don't have to pay capital gains tax on the crypto you receive. This is because crypto is considered a currency, and therefore isn't subject to capital gains tax.

Another exception is if you hold your crypto for more than 12 months before selling it. In this case, you may be eligible for a 50% discount on your capital gains tax in Australia, or a lower rate in Germany.

Of course, there are other exceptions and rules that may apply to you, so it's always best to speak with a tax advisor to make sure you're complying with the law.

What Are the Penalties for Not Paying Crypto Taxes?

If you don't pay crypto taxes, you could be subject to interest and penalties from the IRS. In addition, you may have to pay capital gains tax on the entire value of your crypto holdings, even if you've only made a small profit.

So it's important to stay up to date with the latest crypto tax laws and make sure you're paying what you owe. The good news is that there are now many software platforms that can help you with this, so you don't have to go it alone.

Crypto taxes are complicated, but they don't have to be. By using crypto tax software, you can automate the process and make sure you're compliant with the law. So if you haven't started tracking your crypto taxes yet, now is the time!

Has Anyone Become Rich From Bitcoin?

The short answer is yes, there are people who have become rich from Bitcoin. However, it's important to keep in mind that Bitcoin is a volatile asset and its value can go up or down. This means that anyone who invests in Bitcoin could potentially make a lot of money, but they could also lose all of their investment.

Some people who have become rich from Bitcoin have done so by investing early and holding onto their coins for a long time. Others have made their fortune by trading Bitcoin on a regular basis and taking advantage of the volatility.

Of course, there are also people who have lost money from Bitcoin. So it's important to be careful when investing in any asset, including crypto.

If you're thinking about investing in Bitcoin, make sure you do your research and only invest what you can afford to lose. crypto tax software can help you track your investments and calculate your taxes so you can stay compliant.

So if you're ready to take the plunge, remember to use crypto tax software to keep track of your crypto taxes!

What Is the Most Popular Cryptocurrency?

The most popular cryptocurrency is Bitcoin, which was created in 2009. Bitcoin is a decentralized asset that can be used as a payment system and store of value. It's popularity has grown exponentially in recent years, with more and more people using it as an investment or payment method.

Other popular cryptocurrencies include Ethereum, Litecoin, and Solana. These assets all have different use cases and are traded on different exchanges.

So if you're looking to invest in crypto, make sure you do your research and choose the asset that's right for you. And don't forget to use crypto tax software to stop the IRS from trying to steal all of your money!

How Does Crypto Tax Software Work?

Crypto tax software works by tracking your crypto transactions and calculating your taxes owed. This way, you can be sure you're paying the right amount of tax on your crypto profits.

Most crypto tax software platforms offer a variety of features, such as support for multiple exchanges, portfolio tracking, and tax loss harvesting. Some platforms even offer crypto IRA accounts so you can grow your crypto holdings tax-free!

When choosing a crypto tax software platform, make sure to pick one that's easy to use and offers the features you need. You should also consider the cost of the platform and whether it offers free or paid plans. You check check our guide to the best crypto tax software here.

Once you've chosen a platform, sign up for an account and connect your cryptocurrency wallets. Then all you need to do is start tracking your crypto transactions and the software will do the rest!

Crypto Tax Rate Per Country

| Country | Tax Rate |

| United States | 0% to 37% |

| United Kingdom |

|

| India | 30% |

| Netherlands | 31% |

| Italy | 26% |

| Australia | 0% to 37% |

| Canada | 15% to 29% |

What is Crypto Tax Loss Harvesting?

Crypto tax loss harvesting is a strategy used to offset capital gains taxes. It involves selling assets that have lost value and using the losses to offset gains from other investments.

This strategy can be used with any type of investment, including crypto. For example, let's say you bought Bitcoin for $100 in January and it's now worth $300. You could sell your Bitcoin and use the $200 loss to offset capital gains from other investments.

Crypto tax loss harvesting can be a complex process, but it's made much easier with crypto tax software. This type of platform can track your crypto holdings and calculate your realized and unrealized gains so you can maximize your tax savings.

So if you're looking to reduce your tax bill, consider using crypto tax software to harvest your losses. It could save you a lot of money in the long run!