Ever looked at your Pinterest board full of dream kitchens and lush backyard retreats and thought, “I wish I could make these transformations happen without breaking the bank”? Welcome to the vibrant world of home improvement loans—a financial tool that helps transform your living space into the dream haven you’ve always wanted, whether that means a sleek new open-concept kitchen or a radical backyard makeover perfect for Insta-worthy hangouts. In this guide, we’re diving deep into what a home improvement loan is, how it works, why it might be the secret sauce behind your DIY dreams, and all the insider tips you need to navigate the process with confidence and style.

What Is a Home Improvement Loan Table of Contents

The 411 on Home Improvement Loans: What Are They, Anyway?

Why Consider a Home Improvement Loan?

Types of Home Improvement Loans: Which One is Right for You?

The Nitty-Gritty: How Home Improvement Loans Work

Benefits of Home Improvement Loans: More Than Just Pretty Walls

Understanding Interest Rates and Loan Terms

Qualifying for a Home Improvement Loan: What Lenders Are Looking For

Step-by-Step Guide to Applying for a Home Improvement Loan

Diving Into the Dollars and Cents: Managing Your Loan Repayments

Tips and Tricks for Maximizing Your Home Improvement Loan

Evaluating the Impact: Home Improvement Loans and Your Financial Health

Resources and Community Support: Your Next Steps

Real-Life Renovation Stories: Inspiration in Action

Future-Proofing Your Home: Strategic Renovation for Long-Term Benefits

Expert Advice and Pro Tips: Making the Most of Your Loan

Embracing Financial Wellbeing Through Smart Renovations

The 411 on Home Improvement Loans: What Are They, Anyway?

Simply put, a home improvement loan is a type of financing designed specifically to help you fund renovations, upgrades, or repairs to your home. Whether you're looking to modernize your old bathroom, add an extra room, or simply fix that leaky roof, these loans can cover everything from major structural changes to those chic cosmetic tweaks that make your house truly feel like a home.

Unlike a traditional mortgage, which is used to purchase a home, a home improvement loan focuses on the transformation of your existing space. Think of it as giving your house an aesthetic facelift, similar to how you’d update your wardrobe for a fresh new look. And the best part? Home improvement loans are available to nearly everyone—from first-time renovators like young professionals to savvy Gen Zers planning their first big DIY project.

These loans can come in many shapes and forms, such as personal loans, secured lines of credit, or even specialized home equity loans. Each option has its own perks and quirks, so buckle up as we explore these financial flavors and help you decide which one might be your perfect match.

Why Consider a Home Improvement Loan?

Let’s face it—home improvement projects are as necessary as your daily dose of memes. You can’t just wait for your outdated kitchen to magically become a culinary masterpiece, nor will your creaky old roof fix itself. A home improvement loan can be the catalyst that gets those projects off the ground (or off the Pinterest board) and into reality.

Here’s why these loans might be the answer to your home transformation prayers:

- Access to Funds Without Draining Your Savings: Instead of dipping into your rainy-day jar, you can borrow money at competitive rates to fund your projects and pay it back over time.

- Increased Home Value: Strategic renovations can boost your home’s market value. That new kitchen, upgraded bathroom, or eco-friendly improvements aren’t just for aesthetics—they’re investments in your future resale value too.

- Customizable Financing Options: From secured loans with lower rates to unsecured personal loans for smaller projects, the options are abundant and can be tailored to your financial needs.

- Simplified Process: Many lenders offer streamlined applications with fast approvals, which means you could be picking out new countertops sooner rather than later.

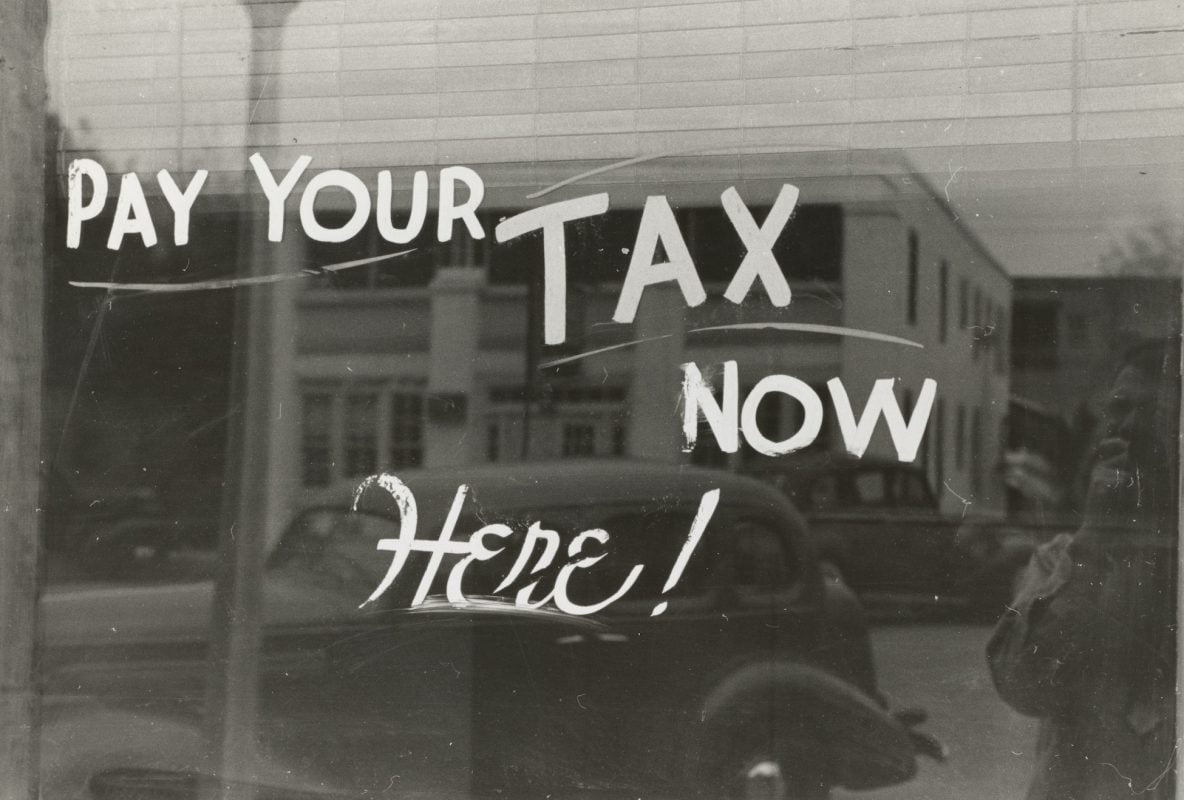

- Tax Benefits: Under certain conditions, the interest on home improvement loans might be tax deductible, helping you offset some of the costs come tax season (always check with your tax pro).

Simply put, if you’re dreaming about reimagining your space but are worried about the upfront costs, a home improvement loan is your ticket to making those dreams come true without the financial red flags.

Types of Home Improvement Loans: Which One is Right for You?

Home improvement loans aren’t a one-size-fits-all deal. Depending on your situation, credit score, and the scope of your renovations, different loan types might be more suitable. Let’s break down the main contenders:

1. Home Equity Loans

If you’ve built up some equity in your home, you might consider a home equity loan. This type of loan lets you borrow against the value you’ve accumulated in your property. Think of it as taking a portion of your home’s worth and converting it into cash. With fixed interest rates and predictable monthly payments, home equity loans offer a sense of stability and are great for large-scale projects.

2. Home Equity Lines of Credit (HELOCs)

HELOCs function similarly to credit cards—you get a revolving line of credit based on your home’s equity. Ideas pop into your head when you’re halfway through a renovation, and HELOCs let you access cash as needed up to your limit. Keep in mind, though, that rates on HELOCs can be variable, so your payment amounts may change over time.

3. Unsecured Personal Loans

If you don’t have enough home equity or prefer not to use your property as collateral, unsecured personal loans might be the way to go. While these loans typically come with higher interest rates compared to secured options, they are easier to qualify for and don’t require your home as security. Personal loans are best suited for smaller-scale improvements or projects with a modest budget.

4. FHA 203(k) Loans

For those interested in purchasing a fixer-upper, the FHA 203(k) loan combines the mortgage and renovation costs into one package. You can buy the property and fund the repairs with a single loan. This option is particularly attractive to first-time home buyers who want to invest in a property that needs a little TLC.

5. Renovation Mortgage Loans

Similar to the FHA 203(k), renovation mortgage loans allow you to roll the cost of renovations into your mortgage. However, these loans can be available through conventional mortgage programs too, providing more choices for borrowers with varying credit backgrounds.

Understanding these different types of loans and how they align with your financial goals is key. Each option has its own eligibility requirements, interest rate structures, and repayment terms—so it pays to do your homework (and maybe even consult with a financial advisor).

The Nitty-Gritty: How Home Improvement Loans Work

When it comes to home improvement loans, the process isn’t as intimidating as assembling a piece of flat-pack furniture without the instructions. Here’s a simple breakdown of how these loans typically work:

- Application: You start by applying for the loan with a lender. During this stage, your credit score, income, and the estimated cost of your project will be evaluated. This is where having all your paperwork ready (i.e., proof of income, renovation estimates, and any collateral documents) can speed things up.

- Approval: Once approved, you’ll receive either a lump sum or a line of credit. The lender will also outline the repayment terms and interest rate. For home equity loans and HELOCs, the amount you can borrow is based on your home’s appraised value.

- Disbursement: Depending on the loan type, funds may be disbursed in one go or over time as you complete phases of your project. For instance, a contractor might receive payments at different stages of the renovation process.

- Repayment: You’re then responsible for repaying the loan, usually with monthly payments that include both principal and interest. The length of these payments can range from a few years to a couple of decades, depending on the loan terms.

- Completion: As your home transforms before your eyes, you’ll be steadily paying off the loan, building equity, and, ideally, enjoying your revamped space even more each day.

While the process might seem like a lot of paperwork initially, it’s all about setting the stage for a smoother, more controlled renovation project with clearly defined financial boundaries. And remember—every month you chip away at that balance, you’re not just paying off a loan; you’re investing in a better quality of life.

Benefits of Home Improvement Loans: More Than Just Pretty Walls

Sure, a home improvement loan might initially sound like just another way to borrow money, but the benefits extend far beyond simply covering renovation costs. Here’s a look at some of the deeper advantages:

- Enhanced Quality of Life: Upgrading your space can dramatically improve your daily comfort, functionality, and even mental wellbeing. Picture a cozy reading nook, a modernized kitchen, or a backyard oasis that becomes your personal retreat.

- Energy Efficiency and Savings: Many home improvement projects focus on energy efficiency—installing new windows, upgrading insulation, or adding solar panels. These enhancements not only reduce your carbon footprint but also lower utility bills in the long run.

- Increased Property Value: Strategic renovations typically yield a higher market value for your home. Whether you decide to sell in the future or simply build equity, you’re making a smart financial decision.

- Flexibility and Customization: Home improvement loans provide you with the flexibility to fund multiple projects at once or tailor your renovation to your specific needs. This freedom can mean the difference between a cookie-cutter update and a truly personalized dream home.

- Low Interest Rates: Depending on the type of loan you choose—especially when borrowing against your home’s equity—you could secure a lower interest rate compared to other personal loans. Lower rates mean you end up saving money over the life of the loan.

By taking out a home improvement loan, you’re not just financing renovation projects; you’re investing in a lifestyle upgrade designed to make your living space a source of pride, productivity, and happiness.

Understanding Interest Rates and Loan Terms

One of the most critical aspects of home improvement loans is the interest rate and the loan term. These components determine how much you’ll pay over time and how comfortably the monthly payments fit into your budget. Let’s break it down in a way that won’t put you to sleep:

Interest Rates: Fixed vs. Variable

When you’re comparing loans, you’ll encounter two main interest rate options:

- Fixed-Rate Loans: With a fixed-rate loan, your interest rate remains unchanged over the life of the loan. This means predictable monthly payments and peace of mind knowing that fluctuations in the market won’t affect your rate. It’s like having a reliable friend who always shows up on time.

- Variable-Rate Loans: Variable-rate loans can change over time based on market conditions. Initially, you might snag a lower rate, but there’s the potential for increases down the road. They can be great if you’re inclined to take a bit more risk for the possibility of saving money in the short term—kind of like riding a roller coaster if that’s your jam.

Loan Terms: Length and Payment Structure

Loan terms can range widely:

- Short-Term Loans: Typically 1–5 years. These loans have higher monthly payments but save you money on interest over the long run.

- Long-Term Loans: These can stretch from 10 to 30 years, resulting in lower monthly payments. However, longer terms mean you may pay more interest over the life of the loan.

The trick is to find a balance between monthly affordability and total interest costs over time. Calculate your budget, understand your repayment capabilities, and choose a loan term that aligns with your financial goals and the anticipated benefits of your renovation.

Qualifying for a Home Improvement Loan: What Lenders Are Looking For

Before you get too excited about redecorating, it’s important to understand that lenders will scrutinize a few key aspects of your financial life. Here’s what they typically look at:

- Credit Score: A higher credit score can unlock better interest rates and more favorable terms. Keep an eye on your score and work on improving it if necessary.

- Income Stability: Lenders want proof that you can handle monthly repayments, so a stable income history is crucial.

- Debt-to-Income Ratio: This ratio tells lenders how much of your income is already committed to paying off existing debt. A lower ratio is generally more favorable.

- Appraised Home Value: For loans that use your home as collateral, the current market value will directly influence how much you can borrow.

- Project Estimates: Detailed estimates for the improvements you plan to make can help justify the loan amount to your lender.

Getting pre-approved for your loan can give you a better sense of the budget to play with and also strengthen your bargaining position with contractors. It’s a good idea to shop around, compare offers, and negotiate terms that work best for your unique situation.

Step-by-Step Guide to Applying for a Home Improvement Loan

Not sure how to dive into the loan application process? Don’t sweat it. Here’s a step-by-step guide that’ll help you navigate the process smoothly:

Step 1: Assess Your Renovation Needs

First, outline the scope of your project. Identify what areas need work, get quotes from contractors, and decide on a rough budget. This exercise isn’t just about numbers—it’s about prioritizing your dream makeover.

Step 2: Check Your Financial Health

Before applying, review your credit score, income, and current debts. Address any discrepancies or issues that might interfere with loan approval.

Step 3: Research Lenders

Time to hit the internet and compare lenders. Look at banks, credit unions, and online lenders who offer home improvement financing. Compare interest rates, terms, and fees to ensure you get the best deal.

Step 4: Gather Necessary Documentation

Lenders will ask for various documents such as proof of income, tax returns, credit histories, and a detailed estimate of your renovation costs. Organizing these documents in advance can streamline the process and reduce stress.

Step 5: Submit Your Application

This is the moment of truth! Fill out your application accurately and attach all the required documents. Many lenders offer online applications to make things easier.

Step 6: Receive Approval and Compare Offers

Once your application is reviewed, you’ll receive an approval (or requests for additional information). Take time to compare offers from different lenders before making your decision.

Step 7: Close the Deal and Start Renovating

After selecting the best option, finalize the paperwork, receive your funds, and kick off your home improvement project. Before you know it, your home will be on its way to a stunning transformation.

Diving Into the Dollars and Cents: Managing Your Loan Repayments

Securing the loan is only half the journey—the next part is managing your repayments without breaking a sweat (or your budget). Here are some savvy strategies to keep your finances in check:

- Automate Your Payments: Setting up automatic payments via your bank can help ensure you never miss a deadline, eliminating late fees and potential credit score dips.

- Create a Budget: Integrate your monthly loan repayments into your budget. Track your expenses and cut back on non-essential spending to free up funds.

- Consider Early Payments: If you come into extra cash, making early or extra payments on your loan can significantly reduce the total interest owed over time.

- Monitor Interest Rate Fluctuations: If you’ve opted for a variable-rate loan, keep an eye on market trends. Refinancing or switching to a fixed rate in a favorable market might be an option to explore down the road.

Being proactive with your repayments doesn’t just alleviate stress—it also positions you for future financial opportunities. Remember, every payment is a step closer to owning your renovated masterpiece free and clear.

Tips and Tricks for Maximizing Your Home Improvement Loan

Ready to take your DIY game to the next level? Here are some insider tips to help you get the best bang for your buck when using a home improvement loan:

- Plan Thoroughly: A solid plan and detailed estimates can prevent unforeseen costs and help you stick to your budget. A well-researched plan can also impress lenders, making approval easier.

- Compare Multiple Quotes: Don’t settle for the first quote you receive. Shop around and negotiate with contractors to get competitive rates.

- Combine Projects: Bundling several related improvements (like kitchen upgrades with energy-efficient lighting) can often be more cost-effective, giving you scope for discounts and bundled pricing.

- Shop During Sales: Timing your purchases for seasonal sales or discount events can lead to substantial savings on materials and appliances.

- DIY Where Possible: Save money by tackling projects you’re comfortable with. Whether it’s painting walls or installing fixtures, channel your inner weekend warrior to cut down costs.

These strategies are designed to help you optimize every dollar borrowed, ensuring that your home improvement projects not only enhance your space but also represent wise financial decisions.

Evaluating the Impact: Home Improvement Loans and Your Financial Health

It’s easy to get swept up in the excitement of redesigning your home, but it’s important to take a step back and consider the long-term financial impact. A home improvement loan, when managed responsibly, can be a strategic investment in your future. Here’s why:

- Equity Buildup: Well-executed improvements can significantly raise your home’s valuation, increasing your net worth over time. It’s like putting money back into your property bank account.

- Tax Advantages: In some cases, the interest paid on home improvement loans may be tax deductible, easing your overall financial burden. A quick chat with your tax advisor can clarify what applies to your situation.

- Long-Term Savings: Upgrading to energy-efficient systems and appliances can yield long-term savings on utility bills, enhancing your overall financial picture while also benefiting the environment.

- Flexibility for Future Projects: Successfully managing one loan can prepare you for future financing opportunities, whether it’s another renovation or a different type of investment.

Ultimately, your decision to take out a home improvement loan should be as much about boosting your immediate living conditions as it is about building a stronger financial future.

Resources and Community Support: Your Next Steps

Venturing into a home makeover financed by a home improvement loan might feel like stepping into uncharted waters, but you’re not alone on this journey. Here are some practical resources and community support systems that can help you navigate each step:

- Financial Advisors and Loan Officers: These professionals can offer personalized advice tailored to your situation. They can help you understand the pros and cons of various loan types and assist in setting up a realistic budget.

- Home Renovation Websites and Blogs: Platforms like Houzz, This Old House, and Remodelaholic are treasure troves of inspiration, expert advice, and step-by-step guides for DIY enthusiasts.

- Community Forums and Social Media Groups: Join online communities on Reddit, Facebook, or local neighborhood groups where you can ask questions, share experiences, and even swap contractor recommendations.

- Local Workshops and Home Improvement Shows: Many hardware stores and community centers offer free workshops that cover everything from budget planning to hands-on DIY skills. Check your local listings to stay informed.

- Renovation Calculators and Budgeting Tools: Use online calculators to estimate costs, manage your project timeline, and track expenses. Tools like HomeAdvisor and Remodeling Calculator can be lifesavers.

The key is to leverage these resources to build confidence and get informed. The more you know, the smoother your home improvement journey will be. And remember, every homeowner started somewhere—join the community, ask questions, and enjoy the process of turning your house into your dream home.

Real-Life Renovation Stories: Inspiration in Action

There’s no better motivator than real-life transformations. Let’s dive into some inspiring stories from folks who took the leap with a home improvement loan and saw their dreams come to life:

The Urban Loft Revival

Meet Alex—a young professional living in a trendy urban loft that was more “fixer-upper” than “chic retreat.” Frustrated with outdated fixtures and a cramped layout, Alex applied for a home improvement loan and set out to revamp the space. The result? A modern, airy loft complete with an open floor plan, energy-efficient windows, and a minimalist design that screams style. Alex’s project not only increased the property’s value but also became the talk of the building, inspiring neighbors to embark on their renovation adventures.

A Family’s Dream Kitchen Transformation

Jessica and her family were stuck with an old, cramped kitchen that made cooking feel more like a chore than a joy. With a home improvement loan in hand, they modernized the space with smart appliances, a large island, and eco-friendly features that made meal prep both fun and efficient. The renovation brought the family closer together, making their kitchen the heart of their home—a place of shared stories, laughter, and delicious meals.

Eco-Upgrades for a Greener Home

For environmentally conscious Sam, the renovation was all about sustainability. By funding a series of green upgrades—including solar panels, energy-efficient heating systems, and sustainable building materials—with a home improvement loan, Sam not only reduced monthly energy bills but also created a model home that inspires eco-friendly living. This project shows that financial decisions and environmental consciousness can go hand in hand, fostering a lifestyle that’s both economically and ecologically beneficial.

These stories underscore the transformative impact a well-planned home improvement project can have—not just physically, but emotionally and financially as well. They serve as a reminder that with the right tools (and a little savvy borrowing), you can turn even the most outdated space into something truly spectacular.

Future-Proofing Your Home: Strategic Renovation for Long-Term Benefits

Beyond immediate aesthetic enhancements, home improvement loans can be a smart part of a long-term strategy to future-proof your home. As technology evolves and housing trends shift, making upgrades now can save you from costly overhauls later. Here’s why proactive renovations are winning moves:

- Smart Home Integration: From voice-activated lighting systems to energy-efficient appliances, modernizing your home with smart technology can provide convenience and reduce long-term operating costs.

- Resale Value Optimization: Future buyers will appreciate a home that’s been thoughtfully updated, making your property stand out in a competitive market.

- Building Versatility: Renovations that enhance flexibility—like open-concept designs and multi-functional rooms—can adapt to changing family dynamics and lifestyle needs.

- Energy and Cost Savings: Upgrading to green technologies isn’t just eco-friendly; it can also lead to significant savings on utilities, providing both environmental benefits and financial returns.

By viewing your renovation as both an immediate improvement and a long-term investment, you’re not only enhancing your living space but also laying the groundwork for a financially secure future.

Expert Advice and Pro Tips: Making the Most of Your Loan

Whether you’re a DIY novice or a seasoned renovator, the following expert tips can help you navigate your home improvement project like a pro:

- Do Your Homework: Research materials, trends, and innovative design ideas. Understanding the market can help you negotiate better deals and identify where to splurge versus where to save.

- Plan for Contingencies: Always set aside about 10-20% of your budget for unexpected expenses. Renovations rarely go exactly as planned, and a cushion can prevent panic when surprises pop up.

- Build a Trustworthy Team: Choose contractors and designers with proven track records. Reading reviews, asking for recommendations, and checking portfolios will pay off in quality and reliability.

- Keep Communication Open: Regularly check in with your team to ensure that timelines and budgets remain on track. Transparent communication can nip potential issues in the bud.

- Monitor Your Progress: Document your renovations through photos and detailed notes. Not only will this help with future maintenance and resale, but it’s also a fun way to see how far you’ve come.

Leveraging expert advice transforms the renovation process from a stressful obligation into an exciting adventure—one where every improvement is a step toward a more comfortable, stylish, and financially savvy home.

Embracing Financial Wellbeing Through Smart Renovations

Beyond just improving your physical space, a home improvement loan can be a stepping stone toward overall financial wellbeing. It’s about making choices that not only enhance your quality of living but also contribute to your long-term financial goals. Think of it as a way to invest in an asset that pays dividends in comfort, efficiency, and equity growth.

For millennials and Gen Zers especially, who often walk the tightrope between financial responsibility and pursuing their dream lifestyles, smart renovations mean you get the best of both worlds. With careful planning and savvy borrowing, you’re not just renovating a home—you’re curating an environment that supports your personal growth, social lifestyle, and future ambitions.

Home Improvement Loan FAQs: Your Burning Questions Answered

If you’re still on the fence or have lingering questions about home improvement loans, check out these frequently asked questions that tackle the nitty-gritty details:

1. What is a home improvement loan?

A home improvement loan is a type of financing designed to fund renovations, upgrades, or repairs to your home. It can come in various forms, including home equity loans, HELOCs, unsecured personal loans, and specialized mortgage packages.

2. How do home improvement loans differ from traditional mortgages?

Traditional mortgages are used to purchase a home, while home improvement loans are specifically for financing work on your existing property, helping to increase its value or simply update its features.

3. Can I use a home improvement loan to increase my property’s value?

Yes, many renovations financed through these loans—like kitchen remodels, bathroom upgrades, or energy-efficient installations—can significantly boost your home’s market value.

4. What types of home improvement loans are available?

Options include home equity loans, home equity lines of credit (HELOCs), unsecured personal loans, FHA 203(k) loans, and conventional renovation mortgage loans.

5. Do I have to use my home as collateral?

It depends on the type of loan. Home equity loans and HELOCs require your home as collateral, whereas unsecured personal loans do not.

6. How can I qualify for a home improvement loan?

Lenders typically assess your credit score, income stability, debt-to-income ratio, home equity (if applicable), and detailed project estimates. A strong financial profile increases your chances of approval.

7. What interest rate options are available?

Home improvement loans can have fixed or variable interest rates. Fixed rates offer stability, while variable rates might start lower but can fluctuate based on market conditions.

8. Are there tax benefits associated with home improvement loans?

In certain cases, the interest on home improvement loans may be tax deductible, though it’s best to consult with a tax professional for specific guidance.

9. Can I refinance my home improvement loan later on?

Depending on your lender and the loan terms, refinancing might be an option to secure a lower rate or better repayment conditions in the future.

10. How long does the application process typically take?

With streamlined online applications, many lenders can process approval in as little as a few days to a couple of weeks. Preparing all necessary documents in advance can speed up the process considerably.

Your Journey to a Dream Home Starts Here

Home improvement projects can feel like a roller coaster—exciting, a bit nerve-wracking, and absolutely worth the ride. With a home improvement loan, you’re not only funding a renovation; you’re investing in a lifestyle upgrade that enhances your everyday living and builds lasting equity in your property.

Whether you’re modernizing your space for better energy efficiency, renovating to create a more open and inviting layout, or simply adding stylish updates, each step brings you closer to the home of your dreams. Embrace the process with a sense of adventure, lean on expert advice when you need support, and use the financial tools available to turn your vision into reality.

Imagine the satisfaction of hosting a housewarming party in a beautifully updated home that not only reflects your personal style but also represents a smart financial move. Every detail—from the color of your new backsplash to the energy savings of your upgraded windows—contributes to a brighter, more profitable future.

Take the leap today, explore your financing options, and let your creativity run wild. Your journey towards an inspiring, personalized, and financially sound home begins now. Turn those Pinterest dreams into tangible, everyday realities and celebrate the unique space that you call home.