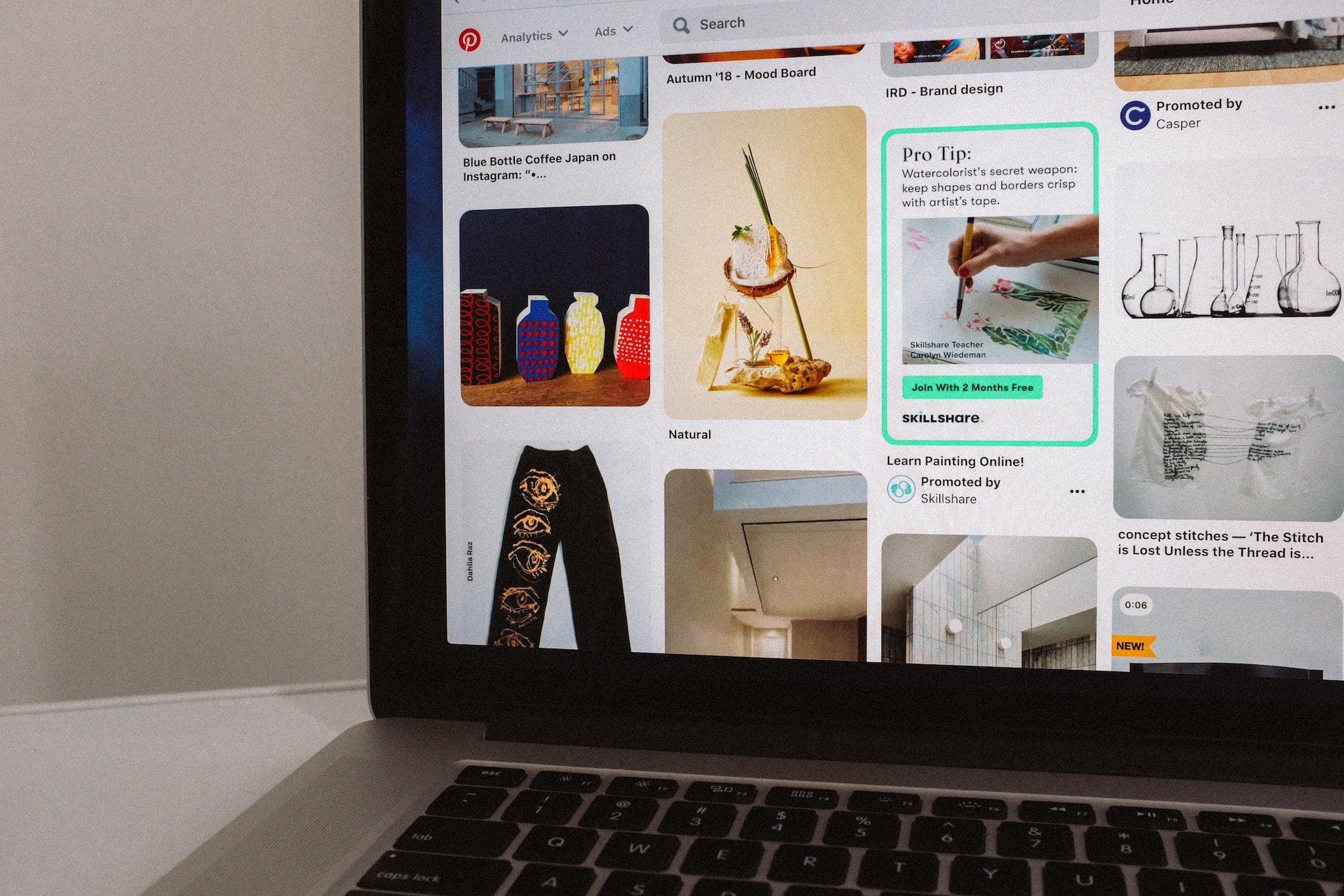

Ready to dive into the world where finance meets creativity? Imagine getting the perfect credit card that not only boosts your financial wellbeing but also supercharges your Pinterest ads in 2025. This guide is your no-BS, down-to-earth companion to decoding the best credit cards tailored for digital ad enthusiasts, millennials, and Gen Zers who are ready to make smarter financial decisions while rocking their social media campaigns.

Best Credit Cards For Pinterest Ads in 2025 Table of Contents

Decoding the Intersection of Credit Cards and Pinterest Ads

What Makes a Credit Card Ideal for Pinterest Ads?

Navigating the Financial Landscape of 2025

Top Credit Card Options to Fuel Your Pinterest Ad Campaigns

Understanding the Financial Benefits: Not Just About the Spend

How to Maximize Your Credit Card for Pinterest Ads in 2025

The Role of Credit Score and Financial Health

Real-World Success Stories: Credit Cards Transforming Pinterest Ads

Resources and Community Support: Your Next Steps

Expert Tips: Balancing Risk and Reward in Digital Advertising

Your Journey to Financial Empowerment with Pinterest Ads

Frequently Asked Questions About Credit Cards and Pinterest Ads

Decoding the Intersection of Credit Cards and Pinterest Ads

If you’re a savvy entrepreneur or a creative mind who lives and breathes Pinterest, you already know that the right ad campaign can make your brand shine brighter than the latest viral trend. But here’s the twist: optimizing your ad spend is just as crucial. Enter the world of credit cards designed for savvy spenders, where rewards, cashback, and promotional offers aren’t just perks—they’re game changers.

In a landscape where digital advertising is evolving faster than you can re-pin your favorite DIY hack, choosing the right credit card can streamline your budgeting process, help you rack up rewards on every spend, and even give you exclusive access to tools and insights that optimize your ad performance. Whether you’re launching a small boutique or managing a large-scale digital campaign, your choice in credit card can make a big difference in your overall financial strategy.

What Makes a Credit Card Ideal for Pinterest Ads?

When we talk about credit cards for Pinterest ads, we’re not just discussing any plastic. We’re looking at cards that combine robust financial features with benefits that directly impact your advertising strategy. Let’s break down the essentials:

- Reward Points and Cashback: Get points that can be redeemed for ad credits, travel, or simply cash back to reinvest in your projects.

- Low Interest Rates: Keep your budget in check even if you occasionally carry a balance, because high interest fees can eat away at your advertising dollars.

- Promotional Offers: Many cards come with introductory 0% APR periods, bonus rewards, or even specific deals on marketing expenses.

- Expense Management Tools: Features like budgeting apps, purchase tracking, and expense categorization simplify the process of managing your marketing investments.

- Extended Protections and Perks: Security features and purchase protection can be a lifesaver if something goes sideways in the digital realm.

Think of these cards as your financial wingman. They not only empower your ad campaigns by maximizing every dollar spent but also provide supportive perks that let you focus more on creative strategy and less on expense headaches.

Navigating the Financial Landscape of 2025

2025 is set to be a landmark year for digital advertising, and Pinterest is no exception. With new features, enhanced analytics, and dynamic ad formats emerging almost daily, your credit card strategy needs to be as flexible and forward-thinking as your campaigns.

Here’s a quick peek at what financial trends are reshaping the ad game:

- Digital-First Finance Tools: Expect credit cards that integrate seamlessly with your favorite digital marketing software.

- Eco-Friendly Incentives: Green rewards programs are in vogue, rewarding you for sustainable practices which may also align with Pinterest’s aesthetic of beautiful, ethical brands.

- Enhanced Security and Fraud Protection: With online transactions at an all-time high, robust security features have become a must-have.

- Customized Cashback Structures: Some new cards offer higher cashback on advertising and software subscriptions—tailor-made for the modern digital marketer.

Understanding these trends is like having the cheat codes for a game. With the right credit card, your ad campaigns are not only funded but optimized to perform at their best against a backdrop of evolving financial and digital landscapes.

Top Credit Card Options to Fuel Your Pinterest Ad Campaigns

Let’s get into the nitty-gritty: Which credit cards are leading the pack when it comes to powering your Pinterest ads? We’ve done our homework so you don’t have to.

The Digital Dynamo Card

Imagine a card that rewards you with extra points for every dollar spent on digital marketing and design subscriptions. The Digital Dynamo Card is built for entrepreneurs who live on the cutting edge. With:

- High cashback on ad spends and software subscriptions

- Zero foreign transaction fees for global ad campaigns

- Integrated spend management tools to track ad budgets in real time

It’s like having a financial advisor in card form, who ensures you’re never overspending on that perfect Pinterest promotion.

The Creative Catalyst Card

If you’re all about turning creativity into conversions, the Creative Catalyst Card is your new best friend. This card is designed for creatives and influencers alike:

- Enjoy a bonus signup offer that yields extra points when you first start your Pinterest campaigns.

- Leverage flexible rewards that let you convert your points directly into ad credits.

- Access to exclusive marketing insights and webinars that help you stay ahead of trends.

It’s perfect for those days when you need that extra push to differentiate your campaigns in a saturated market.

The Budget Booster Card

Tight budgets? No problem. The Budget Booster Card offers low APR and management tools that help keep your spending disciplined while you focus on creative strategy:

- Generous 0% APR for the first year to give your campaigns a strong start.

- Reward tiers that increase for digital spending, perfect for small businesses or startups.

- Enhanced reporting features that help you track your ad ROI every step of the way.

This card is tailor-made for those who want to get more bang for their buck without compromising on quality.

Understanding the Financial Benefits: Not Just About the Spend

When it comes to credit cards, the benefits extend far beyond just covering your ad spend. Here’s how your credit card can serve as a powerful ally in your financial strategy:

- Earn while you spend: With every dollar funneled into your Pinterest ads, you earn points that can be redeemed for cashback, travel, or even more ad credits. Think of it as a never-ending loop of reinvestment into your brand’s success.

- Build your financial credibility: Consistent and responsible use of a credit card improves your credit profile, unlocking better loan rates and even negotiating better terms with potential advertisers or partners.

- Expense tracking and budgeting: Modern credit cards provide real-time insights, letting you monitor exactly where your money is going. This is crucial for pinpointing the ROI on each ad spend, making adjustments, and growing your business sustainably.

- Exclusive perks for creative minds: Some cards offer early access to networking events, designer collaborations, or even digital marketing workshops that hone your campaign strategies. These perks are proof that financial tools are evolving to meet creative needs.

All of these benefits combine to form a robust financial ecosystem that not only supports but actively promotes your digital advertising efforts.

How to Maximize Your Credit Card for Pinterest Ads in 2025

Securing the right credit card is only half the battle. The real magic happens when you use it smartly. Here’s your guide to optimizing every swipe:

1. Set a Clear Budget and Stick to It

Establish a clear monthly ad spend budget and use the expense management tools integrated into your credit card to monitor progress. Planning ahead helps you avoid overspending on spontaneous ad bursts.

2. Leverage Promotional Offers

Keep a keen eye on introductory offers and bonus categories. Many cards offer limited-time promotions that boost your rewards, especially if you funnel your Pinterest ad spend through them during these periods.

3. Utilize Digital Tools for Tracking

Modern credit cards come with smartphone apps and dashboards that assist in tracking your spending in real time. Sync these tools with your marketing calendar to ensure every campaign is executed under your budget.

4. Reinvest Your Rewards

When you earn those points or cashback, reinvest them in your business. Convert rewards into ad credits, invest in better creative software, or simply save up to expand your future campaigns. It’s all about maximizing every dollar spent.

5. Regularly Review Your Strategy

Digital trends shift quickly. Schedule regular reviews of your ad strategy and financial performance. Adjust your spend, tweak your credit card usage, and always keep one eye on evolving promotional opportunities.

By making these smart moves, you transform your credit card from a mere payment tool into a strategic asset powering your Pinterest campaigns.

The Role of Credit Score and Financial Health

Before diving headlong into a new credit card application, it’s essential to understand the impact of your overall financial health. Your credit score isn’t just a number—it’s your passport to better financial tools.

A higher credit score often means you’ll qualify for cards with lower interest rates and more lucrative rewards. It also opens doors to premium cards that may offer exclusive benefits for your digital marketing efforts. Here’s how you can improve your credit health:

- Monitor your credit regularly: Use free credit monitoring services to track your progress and spot any discrepancies early.

- Pay bills on time: Late payments can hurt your score. Set up reminders or automatic payments.

- Keep your credit utilization low: The smaller the balance relative to your credit limit, the better.

- Diversify your credit profile: A mix of credit types can boost your score over time.

Remember, a solid credit score not only makes you an attractive candidate for top-tier cards but also helps manage your overall financial risk. In the competitive realm of Pinterest marketing, this could be the factor that gives you a significant edge.

Real-World Success Stories: Credit Cards Transforming Pinterest Ads

Sometimes, the best way to understand how a tool works is to see it in action. Let’s explore some real-world examples of creative entrepreneurs using the right credit cards to boost their Pinterest advertising game:

The Startup That Sparked a Viral Trend

Meet Sophia, a dynamic entrepreneur who launched a niche eco-friendly brand on Pinterest. She opted for the Digital Dynamo Card for its killer rewards on digital spends. With every ad dollar turned into points, Sophia saw her creative campaigns go viral, turning her modest startup into a trending sensation practically overnight. The cashback she earned enabled her to expand her product line and invest in high-quality visuals that further enhanced her brand’s aesthetic.

The Solopreneur Who Mastered Budgeting

Jamal, a freelance graphic designer, managed every aspect of his business finances with precision. By using the Budget Booster Card, Jamal not only kept his advertising spend in check but also took advantage of its low introductory APR. This allowed him to focus on creating compelling Pinterest ads that showcased his unique style—earning him new clients and turning his one-man operation into a thriving creative consultancy.

The Influencer Revolution

Then there’s Maya, a social media influencer who used the Creative Catalyst Card to elevate her personal brand. With bonus rewards for creative ad spends, exclusive insights, and access to trend forecasting events, Maya consistently stayed ahead of the curve. Her campaigns didn’t just capture attention—they dominated Pinterest feeds, inspiring countless re-pins and shares while solidifying her status as a digital trendsetter.

These case studies prove that with the right credit card strategy, your financial decisions can directly fuel creative success. It’s not just about paying for ads—it’s about leveraging every feature to build a robust, growth-oriented business.

Resources and Community Support: Your Next Steps

No journey is complete without a little help from your friends—especially when those friends are a vibrant community of entrepreneurs, digital marketers, and financial wellness advocates. Here are some essential resources to keep you in the loop:

- Online Forums and Social Media Groups: Platforms like Reddit, Facebook groups, and LinkedIn communities are treasure troves for insider tips on both credit card management and digital ad strategies.

- Financial Blogs and Podcasts: Tune into the latest industry insights by following top financial bloggers or subscribing to podcasts that dissect the intersection of credit management and digital marketing.

- Webinars and Virtual Workshops: Many credit card companies and digital marketing agencies host online events designed to help you maximize your ad spend and refine your financial strategy.

- Credit Card Comparison Tools: Use reputable websites and mobile apps to compare credit card features, read user reviews, and determine which card best fits your unique business model and advertising goals.

- Local Business Networks: Join your local small business association or chamber of commerce for events that mix financial planning with creative inspiration.

Tapping into these resources not only keeps you informed but also connects you with a like-minded community that values financial savvy and creative excellence. Whether you’re a budding entrepreneur or a seasoned marketer, the collective wisdom of the community will help you navigate the complex world of credit cards and Pinterest ads.

Expert Tips: Balancing Risk and Reward in Digital Advertising

In the fast-paced realm of Pinterest ads, the balance between risk and reward is crucial. Sure, the allure of bold, eye-catching campaigns is hard to resist, but behind every successful strategy lies a disciplined approach to spending and risk management. Here are some expert tips to help you strike the perfect balance:

Keep a Laser Focus on ROI

Every dollar spent should be seen as an investment in your brand’s future. Use your credit card’s detailed reporting tools to track which campaigns deliver the best return on investment. If a particular strategy isn’t working, be ready to pivot and redirect your spend.

Make Informed Decisions

Take advantage of financial planning tools and expert advice that many credit card platforms offer. From budgeting calculators to monthly spend summaries, these insights help you steer your campaigns away from unnecessary risks.

Diversify Your Ad Budget

Just like any savvy investor diversifies their portfolio, spread your ad budget between high-performing campaigns and experimental ones. This minimizes risk in the event one campaign doesn’t hit the mark while still leaving room for innovation.

Regularly Update Your Strategy

Digital trends evolve at breakneck speed. That’s why continuous education, market analysis, and regular strategy updates are key. Utilize online courses or consult industry experts to ensure your advertising playbook reflects the latest financial and digital insights.

The right blend of prudence and creative ambition will allow you to harness the full power of your credit card’s benefits, ultimately leading to more effective and dynamic Pinterest ad campaigns.

Your Journey to Financial Empowerment with Pinterest Ads

Stepping into the future of Pinterest advertising is an exciting adventure—one where the right credit card serves as both your financial safety net and creative catalyst. By harnessing tools that offer targeted rewards and smart budgeting features, you’re not simply paying for ads; you’re investing in your brand’s evolution.

With a clear understanding of what features to look for and a set of expert strategies for optimizing your ad spend, you now have the insight to make decisions that benefit both your financial wellbeing and creative output. It’s a dynamic synergy where financial acumen meets digital innovation head-on.

Embrace a future where every re-pin, every creative spark, and every smart financial move propels you further on your path toward business success. The right balance between risk and reward is within your reach, and your journey to financial empowerment with Pinterest ads is just beginning.

So, whether you’re just starting out or looking for ways to scale your brand, remember that choosing the best credit card for your digital campaigns is more than a financial decision—it’s a strategic move that will support your creative vision and foster long-term success.

Frequently Asked Questions About Credit Cards and Pinterest Ads

We’ve put together answers to some of the most commonly asked questions so you can navigate the intersection of credit card benefits and digital ad strategies with ease.

1. What should I look for in a credit card when funding Pinterest ads?

Look for cards that offer high rewards on digital ad spending, low interest rates, and robust expense tracking tools. Benefits like bonus categories, cashback on marketing spend, and promotional offers are key.

2. Can I maximize my Pinterest ad campaigns with cashback rewards?

Absolutely. Cashback rewards and points can be reinvested into further ad spend, allowing you to grow your campaigns without overspending your cash reserves.

3. Are there credit cards specifically designed for digital marketers?

Yes, several cards are tailored for entrepreneurs and digital marketers. They offer benefits like exclusive marketing insights, flexible reward structures for ad expenditures, and low fees on digital purchases.

4. How do I ensure that my advertising spend remains sustainable?

Use the digital management tools provided by your credit card, set a clear ad budget, and regularly review your ROI. Consistent tracking and planning will help maintain a healthy balance.

5. What financial trends should I watch out for in 2025?

Look for credit cards offering integrated digital tools, eco-friendly rewards programs, and enhanced security measures. These trends indicate a shift towards financial products that are in tune with modern digital needs.

6. How can a credit card improve my overall financial health?

Responsible use of a credit card, including timely payments and appropriate budgeting, can improve your credit score, lower expenses, and provide future benefits through rewards and exclusive offers.

7. Is it possible to use one credit card for multiple ad platforms?

Yes, many of these cards offer rewards and cashback across a variety of digital platforms, though some may have enhanced benefits for specific ad categories such as social media and design tools.

Embracing Financial Savvy and Creative Power

As you venture deeper into the vibrant world of Pinterest ads, remember that the right credit card is more than a piece of plastic—it’s a catalyst for innovation, a tool for smarter spending, and a partner in your creative journey. Every reward point earned, every cashback received, and every promotional offer redeemed is a step toward financial empowerment and greater creative expression.

Balancing the demands of a fast-moving digital advertising landscape with the need for financial discipline may seem challenging, but armed with the insights from this guide, you’re equipped to meet the challenge head-on. Use these strategies to refine your ad campaigns, optimize your spending habits, and ultimately, turn your passion into a profitable venture.

Here’s to a future where your creative ambition is matched by financial acumen. Whether you’re a startup owner, an influencer, or a social media strategist, the right credit card can unlock new levels of success in your Pinterest advertising journey. Choose wisely, spend wisely, and watch your efforts blossom into impressive returns.

Dive in, experiment, and always keep learning. The digital world is ever-evolving, and so too should be your approach to managing your finances and advertising spends. May your campaigns be bold, your budgets be balanced, and your rewards be abundant!