Picture this: you own a sprawling slice of land, and the idea of building your dream home or starting that cutting‐edge business hub fills you with excitement. But wait—before you break out the hard hats and blueprints, let’s talk construction loans. Yes, those magical financial tools that help turn your raw land into a masterpiece, though they come with their own set of twists and turns. If you’re a millennial or Gen Z go-getter ready to navigate the world of financing while keeping your eye on a sustainable financial future, buckle up for a witty, no-nonsense guide on how construction loans work when you already own the land.

How Does a Construction Loan Work When You Own the Land Table of Contents

Decoding Construction Loans: The Basics

Owning the Land: The Benefits and the Baggage

The Construction Loan Process: Step-by-Step

Financial Considerations: Loan Terms, Interest Rates, and More

What Lenders Really Look For When You Own the Land

Navigating Potential Pitfalls: Common Challenges and How to Overcome Them

Budgeting for Success: Smart Financial Strategies During Construction

Resources and Community Support: Your Next Steps

Integrating Technology: Tools and Apps for Construction Loan Management

Your Path to Construction Loan Mastery

Frequently Asked Questions About Construction Loans and Land Ownership

Decoding Construction Loans: The Basics

Construction loans are not your typical home mortgage. They’re specialized financing options designed to cover the costs of building a structure, from laying the foundation to that final brushstroke on the walls. Unlike traditional loans that disburse a lump sum, these loans often work on a “draw” basis—money is released in stages as construction milestones are met. Think of it as a financial relay race, where each baton pass represents a new phase of construction.

When you already own the land, the equation changes. In many respects, owning the land might make you look like a savvy investor because you’ve cleared one major hurdle—land acquisition. However, lenders will scrutinize your overall project plan, construction timeline, and budget more closely. They want to make sure that all your ducks (or in this case, blueprints) are in a row before they hand over the cash.

In this section, we’ll break down the essentials. We’re talking about the unique features of construction loans, the draw schedule process, interest rate structures, and why owning the land can be both a perk and a challenge. By the end of this section, you’ll have a clear understanding of what a construction loan is, how it differs from other forms of real estate financing, and what makes it the ideal option for transforming your land into a dream project.

Owning the Land: The Benefits and the Baggage

Let’s celebrate you for owning the land! It’s a significant milestone on your financial journey. Owning your land gives you the freedom to choose the right time and style for your construction project. It also strengthens your negotiation power with lenders, as land ownership offers collateral—a safety cushion that lowers potential risks for the lender.

But don’t pop the champagne just yet. Lenders don’t automatically roll out the red carpet because you have a nice patch of earth. The fact that you own the land means you’re responsible for more than just securing the funds for labor and materials; you must also manage zoning permits, environmental inspections, and sometimes even infrastructural improvements. Basically, owning the land is like having a VIP pass that comes with extra responsibilities.

On the bright side, when you already own the property, you might avoid additional costs associated with purchasing land. This can simplify the financing process since the loan only has to cover construction expenses. However, some lenders might see the value of the land as insufficient security if the construction project doesn’t match the market value of the finished structure. In other words, your loan-to-value ratio will be under the microscope.

Whether it’s a shiny new home, a custom office space, or even a unique community project, understanding both the advantages and the potential pitfalls when you own the land is crucial for making informed financial decisions. Embrace the power that comes with ownership, but prepare yourself for the challenges that might sneak in along the way.

The Construction Loan Process: Step-by-Step

Navigating a construction loan is like planning a road trip: you need a detailed itinerary to ensure that every segment of the journey is smooth. Here’s how the process generally unfolds:

Step 1: Pre-Qualification and Planning

Before you even start picking out tiles for the bathroom, you’ll need to meet with potential lenders. Pre-qualification is your opportunity to showcase your asset—the land—and your well-thought-out construction plan. This includes submitting blueprints, timelines, and estimated budgets. Lenders will want to see that you have a clear strategy in place and that you’re prepared for both planned expenses and potential overruns.

Step 2: Loan Application and Approval

With pre-qualification under your belt, the next step is the formal loan application. This is where you’ll provide detailed financial statements, proof of land ownership, and your construction schedule. Lenders typically require a down payment, the size of which depends on their assessment of risk and the overall project cost. If you own the land, you might secure more favorable terms, but every lender has its own playbook.

Step 3: The Draw Schedule

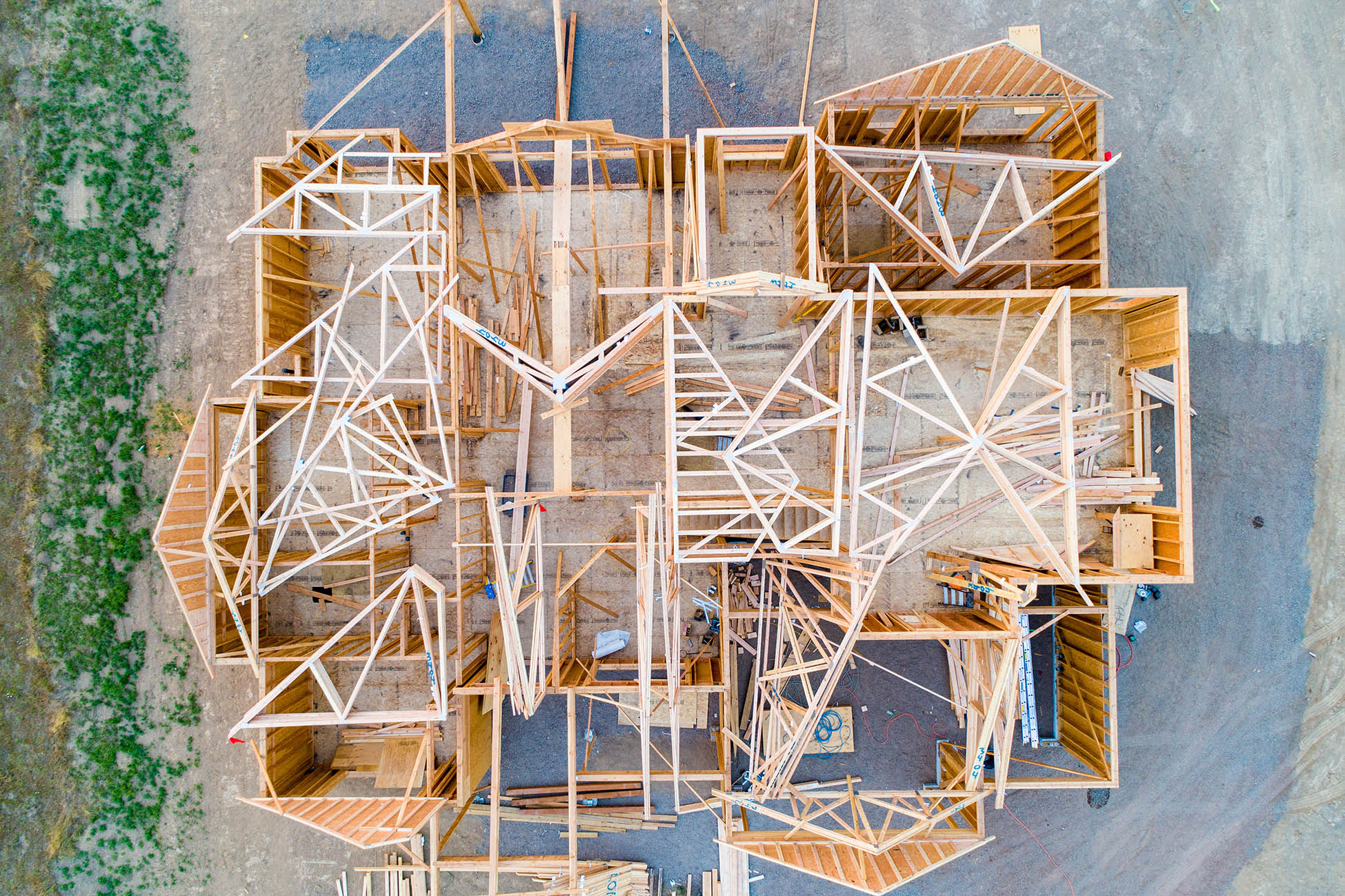

Unlike traditional mortgages, construction loans work a bit like a subscription service—you get paid in installments. A draw schedule outlines the stages of your construction project, releasing funds in intervals as milestones are achieved. For example, funds might be disbursed when the foundation is complete, when the framing is in place, and finally when the finishing touches are added. It’s crucial to adhere to your timeline because delays may trigger additional fees or scrutiny from your lender.

Step 4: Inspections and Disbursements

At each stage, inspections are conducted to ensure that work is progressing as planned. This step is essential for quality control and for triggering the next installment of funds. A trusted contractor who keeps you and the lender in the loop can be a game-changer during this phase, ensuring that every phase meets strict guidelines.

Step 5: Finalizing and Converting the Loan

Once construction is complete, the loan often needs to transition from a construction loan to a permanent mortgage. This “conversion” typically requires a re-application process where the finished property is appraised to determine its full market value. It’s the final checkpoint before you settle into the comfort of a traditional home or business loan.

This step-by-step approach demystifies the process—and yes, there are plenty of moving parts, but armed with the right information, you’re in control. Keep your project timeline realistic, budget for unexpected twists, and make sure every stage of your construction is meticulously documented.

Financial Considerations: Loan Terms, Interest Rates, and More

If you’ve ever tried reading the fine print on a smartphone’s warranty, you know that loan documents can feel just as intimidating. When it comes to construction loans, there are several key factors that demand your attention:

Interest Rates: Unlike fixed-rate mortgages, construction loans may have variable interest rates that can change over time. Some lenders offer an interest-only payment period during construction, which can help keep your monthly payments lower until your building is complete.

Loan Terms: Construction loans typically have shorter terms than permanent mortgages—often ranging from 6 months to a couple of years. This short-term nature means that once your project is complete, you’ll need a solid plan to either refinance into a traditional mortgage or pay off the remaining balance.

Fees and Points: Beyond interest rates, be prepared for fees like processing charges, inspection fees, and sometimes even points (a form of pre-paid interest). Remember, every cent counts in your overall budget, so compare fee structures from different lenders to find the best deal.

Loan-to-Value (LTV) Ratio: This ratio is a critical metric for lenders. It’s the percentage of the project’s total cost financed by the loan relative to the property’s appraised value. Owning the land yourself might improve your LTV ratio, but construction costs, if not managed prudently, can tip the scales unfavorably.

Contingency Reserves: Think of these as extra funds set aside to cover unforeseen expenses. Construction projects rarely go exactly as planned—weather delays, unexpected material costs, or design changes can quickly inflate expenses. A good construction loan will include a contingency reserve, typically 5-10% of the total budget, to keep your project financially afloat.

Financial considerations go beyond simply securing a loan. They encompass ongoing management of your project’s budget, ensuring that funds are used wisely, and preparing for the unexpected. Balancing these financial factors is critical to ensuring that your construction project remains on track and within budget.

What Lenders Really Look For When You Own the Land

When you approach a lender with your plan, owning the land can be a double-edged sword. On one hand, it shows that you’re serious about your project. On the other, it means the lender will dig deep into your overall plan to assess the risk.

Lenders typically evaluate several key factors. First, they want to see that your construction plans are detailed and realistic. This means comprehensive blueprints, a carefully laid-out timeline, and an itemized budget. It’s not the time for vague sketches or wishful thinking—irrefutable data is the name of the game.

Next, your creditworthiness and financial stability come under the spotlight. Lenders will examine your credit score, income streams, and debt-to-income ratio to ensure you’re capable of managing the project’s financial burdens. Owning the land may offer some reassurance, but if your credit history reads like a roller coaster, that could be a red flag.

Additionally, your experience with construction projects can bolster your case. Whether you’ve overseen minor home renovations or spearheaded a larger development, your track record provides lenders with valuable context about your ability to manage the complexities of a construction loan. Even if you’re stepping into uncharted territory, partnering with experienced contractors or project managers can significantly improve your application.

Finally, lenders want to know that the project’s potential value will exceed the total investment. They examine market trends, local property values, and potential resale or rental income. In short, they’re betting on your success as much as you are. A comprehensive business plan that outlines market research, competitor analyses, and projected returns can help convince even the most cautious lender that your project is viable.

By putting together a compelling case—backed by thorough research, a robust plan, and sound financials—you can turn your land ownership into a strong asset in the eyes of a construction loan provider.

Navigating Potential Pitfalls: Common Challenges and How to Overcome Them

As with any financial venture, the road to securing a construction loan when you own the land isn’t without its bumps. One of the most common issues is underestimating the total cost of your project. Even the most meticulously prepared plans can be derailed by unexpected delays or unforeseen expenses.

Overbudgeting Woes: Many projects hit snags when contingency reserves are not adequately set aside. Always plan for a buffer—if something goes awry, you don’t want to scramble for extra funds in the middle of construction.

Timeline Troubles: Delays in obtaining permits, supply chain hiccups, or contractor issues can quickly push your project off schedule. These delays can also affect lender disbursements, leading to higher interest costs or even penalties. Keeping a flexible yet realistic timeline and maintaining regular communication with your contractor can mitigate these issues.

Changing Market Conditions: Real estate markets can be unpredictable, and a downturn might affect your project’s future value. It’s important to have a risk mitigation strategy in place—one that may include refinancing options or exit strategies in case market conditions change abruptly.

Compliance and Permitting: Navigating zoning laws, environmental regulations, and building codes can be a headache. Missing a permit or falling short on compliance can halt construction. Hiring experts who know the local regulatory landscape is not only smart; it’s essential.

Contractor Coordination: A reliable contractor is key to smooth construction loan disbursements. Miscommunications or poor workmanship can trigger delays and additional expenses. Vet your contractors thoroughly, check their references, and if possible, opt for professionals with robust experience in projects of similar scale.

Avoiding these pitfalls isn’t about eliminating risk entirely—it’s about planning for the unexpected and having strategies in place. From budgeting extra funds to scheduling regular project reviews, a proactive approach can mean the difference between a financial fiasco and a successful build.

Budgeting for Success: Smart Financial Strategies During Construction

Budgeting is more than just crunching numbers; it’s the blueprint for financial success. When it comes to construction loans, careful planning can save you from future headaches. Here are some tips to keep your project’s finances on track:

Detailed Expense Forecasting: Break down your budget into line items such as materials, labor, permits, and contingencies. The more granular you get, the easier it becomes to track expenses and spot potential overruns early. Consider using budgeting software or apps designed for construction projects that offer real-time tracking.

Keep Your Credit Healthy: A strong credit score not only helps secure better loan rates but also gives you room to negotiate terms. Pay bills on time, reduce outstanding debts, and monitor your credit report to ensure there are no surprises when you apply for the loan.

Loan Payment Management: During the construction phase, many construction loans offer interest-only payments. Once construction is complete, prepare for higher principal-plus-interest payments as your loan converts to a permanent mortgage. Start planning early for this financial shift.

Regular Financial Reviews: Set up monthly or quarterly meetings with your financial advisor and contractor. These check-ins will help you adjust to any changes in the project, keep an eye on cash flow, and manage funds effectively. Transparency during these reviews builds trust with your lender and helps preempt surprises.

Plan for the Unexpected: As noted before, a robust contingency fund is your safety net. Allocate around 5-10% of your total budget for unexpected expenses. It’s better to have a little extra in reserve than to scramble for funds halfway through construction.

This proactive budget management ensures that your construction loan not only provides the necessary funds but also helps maintain the financial health of your project as it evolves. Having a detailed, adaptable financial plan is key to sustaining momentum and achieving a successful build.

Resources and Community Support: Your Next Steps

When venturing into the realm of construction loans with your own land, you’re not alone in the journey. There’s a bustling community of financial experts, experienced developers, and online forums that offer advice, shared stories, and practical tips. Tapping into these resources can be as valuable as having a seasoned contractor by your side.

Consider joining local real estate investment groups or online communities dedicated to construction financing. Networking events, webinars, and podcasts are also excellent avenues to gain insights—perhaps even discover innovative tips or the latest trends in construction and green building practices.

Additionally, many financial institutions and government programs offer specialized guidance for borrowers embarking on construction projects. Explore these options, attend free workshops, and don’t hesitate to reach out to professionals who can help tailor a plan that meets your unique needs.

Remember, every informed question you ask and every expert advice you follow can add up to a smoother, more financially sustainable project. Whether you’re building a sleek urban loft or a cozy countryside retreat, leveraging community support can transform a potentially complex process into an empowering adventure.

Integrating Technology: Tools and Apps for Construction Loan Management

In our digital age, technology can be a powerful ally in managing the ins and outs of a construction loan. Gone are the days when tracking expenses meant dusty ledgers and endless spreadsheets. Today, smart apps and tools help you keep a real-time pulse on your project’s progress, budget, and timelines.

Platforms like Buildertrend, CoConstruct, or even customized spreadsheets integrated with cloud services offer features such as budgeting dashboards, project scheduling, and even secure communication channels with your lender and contractor. These tools streamline paperwork, reduce human error, and save you countless hours.

For tech-savvy millennials and Gen Zers, leveraging these digital solutions can significantly enhance accountability and transparency. Set up automated reminders for key project milestones and financial reviews. Use digital signatures for approvals, and don’t shy away from exploring innovative financing apps that help predict fluctuations in interest rates and provide real-time market data.

Embracing technology in your construction project isn’t just about convenience; it’s about leveraging every tool available to ensure your loan management is as smart, responsive, and flexible as you are.

Your Path to Construction Loan Mastery

There’s a reason construction loans are often dubbed the “financial backbone” of building projects. By breaking down the process, understanding financial nuances, and anticipating hurdles, you’re setting yourself up for success—even before the first shovel hits the ground.

As you embark on your project, remind yourself that knowledge is power. Each phase of the construction loan process—from pre-qualification to final conversion—offers an opportunity to learn and improve. Armed with these insights, you can navigate not only the loan process but also the broader realm of real estate development with confidence.

Empower yourself with the right financial strategies, partner with experts who speak your language, and tap into the vibrant community around you. Remember, every challenge you overcome is a stepping stone to excellence, and every dollar saved or wisely spent makes your financial future a little brighter.

Whether you’re a first-time builder or a seasoned investor, the insights shared here pave the way for informed decision-making, demystifying the complexities of construction loans. With determination, planning, and a dash of creative problem-solving, your unique vision can transform your bare land into a beacon of innovation and style.

So, take a deep breath, gather your resources, and get ready to embark on one of the most rewarding journeys of your financial life. Building your dream is not just about bricks and mortar—it’s about crafting a legacy, establishing financial independence, and turning aspirations into reality.

Frequently Asked Questions About Construction Loans and Land Ownership

Here are some of the most common questions asked by aspiring builders and investors when it comes to navigating construction loans on land they already own:

1. What exactly is a construction loan and how does it differ from a traditional mortgage?

A construction loan is specifically designed to finance the building process. Instead of releasing funds in a lump sum, money is disbursed in stages as construction milestones are met. Unlike a traditional mortgage, which is based on a completed property’s value, a construction loan focuses on funding the project during its development phases.

2. How does owning the land influence the loan application process?

Owning the land can be both advantageous and challenging. It typically provides added collateral, which might secure better terms. However, lenders will scrutinize the overall project, including the feasibility, construction cost, and planned timeline, to ensure the land’s value is fully leveraged.

3. What are draw schedules, and why are they important?

Draw schedules are disbursement plans where funds are released incrementally as construction milestones (like foundation completion or framing) are met. They are important because they allow the lender to monitor progress and ensure that funds are spent appropriately.

4. Can I convert my construction loan to a traditional mortgage after project completion?

Yes, once construction is completed and the property is fully appraised, you can typically convert your construction loan to a permanent mortgage. This process may involve a secondary loan application based on the finished property’s value.

5. What are some common pitfalls to avoid during the construction process?

Common pitfalls include under-budgeting, unexpected project delays, non-compliance with permits, and poor contractor management. It’s crucial to plan for contingencies, maintain transparent communication, and manage your finances meticulously.

6. How can technology help manage my construction loan effectively?

Modern digital tools and apps offer budgeting, scheduling, and communication platforms that streamline project management, track expenses in real time, and ensure that all parties—from lenders to contractors—remain on the same page.

7. What should I do if unexpected costs arise during construction?

Always have a contingency reserve (typically 5-10% of your budget) for unforeseen expenses. Regularly review your budget, work closely with your contractor, and be prepared to adjust your financial plan if necessary.

8. Is there a specific credit score or financial requirement for construction loans?

Requirements vary by lender, but generally, a sound credit history, stable income, and a manageable debt-to-income ratio are critical. Owning the land can sometimes bolster your application, but overall financial health remains key.

These FAQs are designed to help you navigate the complexities of construction loans while maximizing the benefits of owning your land, so you’re better prepared every step of the way.

Your Next Chapter in Construction Financing

Whether you’re transforming a bare slab of land into a cozy home, a trendy co-working space, or a commercial masterpiece, understanding how construction loans work when you own the land is a game-changer. By grasping the nuances of financing, managing your budget rigorously, and harnessing the power of community and technology, you set the stage for unmatched success.

Remember, every project involves careful planning and strategic decisions at every turn—from selecting the right lender to ensuring your construction milestones are met on time. Your journey through the world of construction financing is as much about financial savvy as it is about vision and creativity.

Embrace the challenges and opportunities that come with owning the land and diving deep into the construction loan process. With detailed planning, proactive management, and the willingness to tap into expert communities, you’re not just building a structure—you’re building a future defined by innovation, resilience, and financial independence.

So gear up, do your research, and let your passion for creating something extraordinary pave the way to a successful construction project. The path to construction financing mastery is waiting—step forward with confidence, and turn your dream into a well-funded reality.