Just a personal opinion, you can fight me on this one:

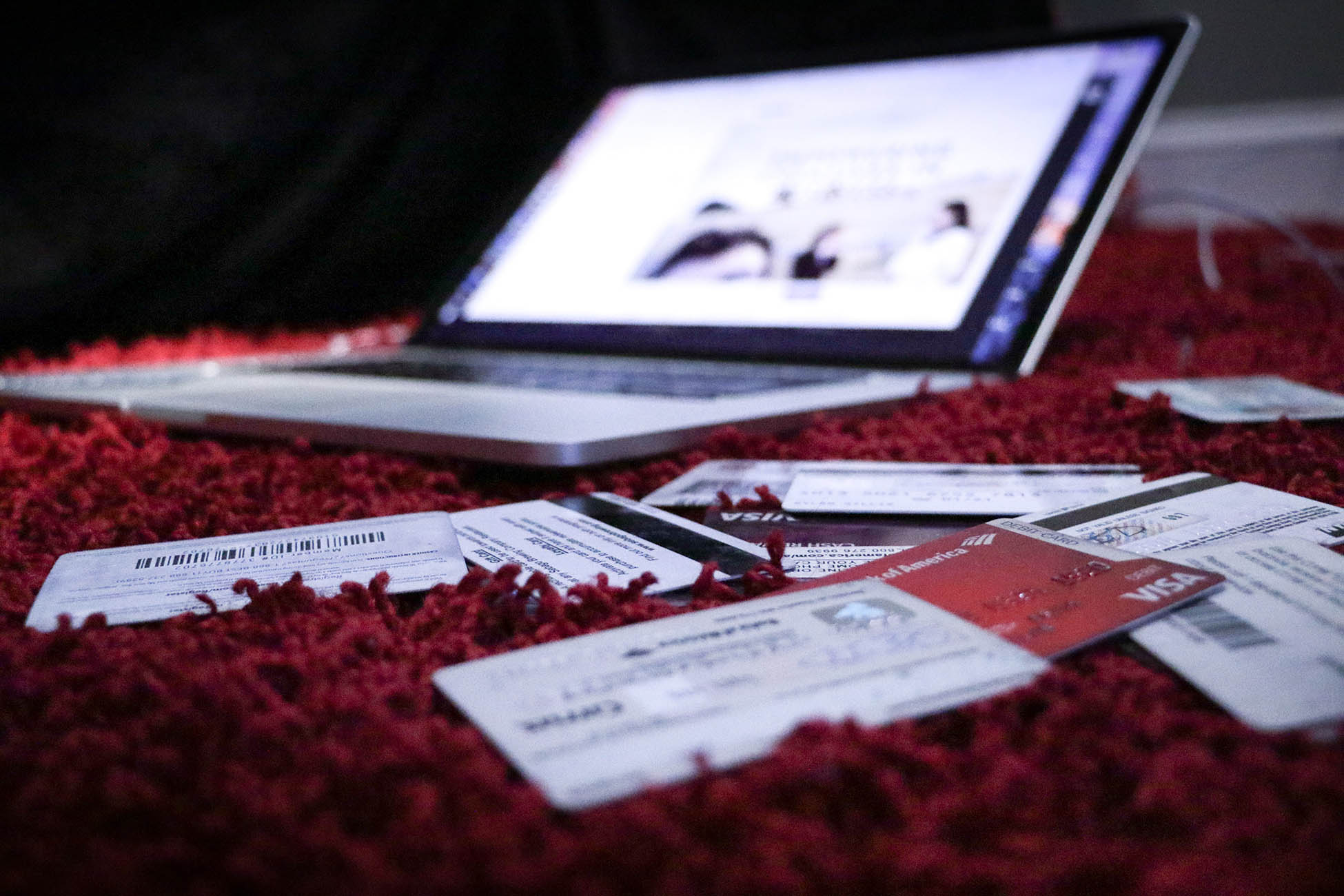

Spiderman’s Uncle Ben should be on the cover of every credit card, sort of like a PSA.

This is to remind everyone that “With great power comes great responsibility.” Mindlessly swiping your credit card and missing payments will ultimately get you something no adult wants: BAD CREDIT. Yes, I said it and you heard it right.

It sucks to be in this credit rut. But hear me out, you can actually turn things around with a credit card. Credit builder cards are here to help you turn your credit score around. Thankfully, there are a lot of credit card companies that are willing to give people with bad credit a second shot.

Quick Links to Useful Sections

Bad Credit? Top 10 Credit Card Builders Reviews Table of Contents

Top 10 Credit Card Builders Reviews Table of Contents

What is a Credit Builder Card?

What is the Annual Percentage Rate (APR) for Credit Builder Cards?

Top 10 Credit Card Builders Reviews Table of Contents

What is a Credit Builder Card?

What is the Annual Percentage Rate (APR) for Credit Builder Cards?

Top 10 Credit Card Builders Reviews

Chime Credit Builder Credit Card

Discover It Secured Credit Card

Capital One Platinum Secured Credit Card

U.S. Bank Cash + Visa Secured Card

Petal 2 Cash Back No Fees Visa Card

Capital One Quicksilver Secured Cash Rewards Credit Card

Chase Freedom Student Credit Card

First Progress Secured Mastercard

What is Bad Credit?

If you feel down about not being approved for that apartment because of your credit score, you’re not alone. 15% of Americans have bad credit. But before we talk about bad credit, you must first understand what all the fuss about a credit score is. A credit score represents your credit risk trustworthiness. It’s measured on a scale from 300 to 850. These aren’t just numbers some credit god randomly assigns: these numbers will ultimately determine the chances of being approved for loans.

A credit score of 300 is considered bad credit. 600 to 800 is a good credit score, meaning there is a greater chance of the bank approving a loan or credit card for you. Bad credit happens when you don’t pay your dues on time or owe a big chunk of money to the bank you haven’t repaid.

What is a Credit Builder Card?

Now to get to the good stuff: turning your credit score around. You can get a special type of credit card called a credit builder card. That’s right, genius. This card does exactly what its name implies: builds your credit.

Credit builder cards are issued to people with a history of bad credit to help them improve their credit score. This credit card builder review will help you understand which credit builder cards are the best for you.

What is the Annual Percentage Rate (APR) for Credit Builder Cards?

The Annual Percentage Rate or APR is the annual cost of a loan to a borrower, including fees. Different banks have varying APRs, but based on our research, the average APR is from 13% to 27%. Don’t look at other credit card builders reviews; they’ll tell you the same thing.

Top 10 Credit Card Builders Reviews

Other credit builder card reviews may tell you some things you need to know. But we’ll discuss everything here for you, so you don’t have to look anywhere else—you can thank us later.

Chime Credit Builder Credit Card

Chime offers convenient funding of your account with its Move My Pay feature. When you avail of a credit builder card from Chime, you don’t need to have a minimum security deposit as long as you have an active savings account.

Features

- No annual fees

- No credit check is needed to apply

- Reports to all three credit bureaus

- No foreign transaction fee

APR

- N/A

Annual Fee

- None

Rating

- We give the Chime Credit Builder Card a 3.5 rating. It’s a great starter credit card to build or rebuild your damaged credit score.

Discover It Secured Credit Card

Discover has made it possible for bad credit people to redeem themselves. The Discover It card offers 100% liability-free coverage for fraudulent purchases, so you won’t have to worry about disputes because, honestly, who has time for those?

Features

- Accepted in 99% of places across the country that takes credit cards

- Free inquiry alerts to notify you of potential fraud

- Probability to graduate to unsecured credit card after seven months

- Refundable deposit

- Rewards redeemable in cash

APR

- 10.99% intro APR for balance transfers for 6 months, then 23.24% variable APR after that

Annual Fee

- None

Rating

- We give the Discover It credit card a 4.8 rating. It’s an excellent card for rebuilding your credit, plus it gives you a lot of perks, such as unlimited cash back.

Capital One Platinum Secured Credit Card

For a minimum deposit of $49, you may be eligible for the Capital One Platinum Secured Credit Card with an initial credit line of $200. This card will also help you build the habit of paying your bills on time, as it offers a deposit back benefit once you qualify as a good payer, and you can also upgrade to the unsecured Platinum card.

Features

- 0% annual fee

- Refundable deposits with responsible card use

- Flexible due dates

- Automatic credit line reviews every six months

APR

- 27.24% variable APR

Annual Fee

- None

Rating

- We’ll give the Capital One Platinum Secured Credit Card a 4.9 rating. The card is like having a trusty rich friend that you need to pay off on time.

U.S. Bank Cash + Visa Secured Card

The U.S Bank allows you to build your credit and earn cash back at the same time. Yup, you heard that right, you get all these benefits in one card. To qualify, you need to make a minimum deposit of $300. Your credit limit will be the same amount as your deposit. You don’t have to worry about delayed payments if you set up autopay. But you still have to worry about funding that account, bro.

Features

- Fraud protection

- Flexible due dates

- Cash back on everyday purchases

- Opportunity to upgrade to unsecured credit card

APR

- 25.99%

Annual Fee

- None

Rating

- We don’t know about other credit card builders reviews, but this card scores a 2.8 on our radar. Not a lot of benefits to expect from this card, plus the $300 is a bit much.

Petal 2 Cash Back No Fees Visa Card

If you’re new to “building your credit,” the Petal 2 Credit Card should be on your radar. You can get pre-approved to determine your eligibility before proceeding with your application. This may be your best bet if you don’t have any credit history.

Features

- No credit history required

- No fees (no annual fees, foreign transaction fees, late fees, or over-limit fees)

- No security deposit required

- Cash back on eligible purchases

APR

- 13%-27.24% variable APR

Annual Fee

- None

Rating

- Our gut tells us to rate this card a 2.5 out of 5. It’s a good card to start with if you’re new to building your credit but always look away if you’re on the bad credit side.

Avant Credit Card

The Avant Credit Card is one of the limited credit builder cards that are unsecured and don’t require a deposit to determine your credit limit. You can also check your eligibility by getting pre-approved online without affecting your credit score. However, the downside to this credit card is that it has no rewards program, unlike other unsecured credit cards.

Features

- Reports to all three credit bureaus

- Minimum $300 credit limit

- Unsecured credit card

- Cash back on eligible purchases

APR

- 24.99% variable APR

Annual Fee

- $0 – $59 depending on creditworthiness

Rating

- We give this card a rating of 2. It’s a good starter unsecured credit card; however, if you want more perks and benefits, this card may not hit all the right spots. Other credit cards listed in most credit builder card reviews may be a better fit for you.

Capital One Quicksilver Secured Cash Rewards Credit Card

The Quicksilver Secured Cash Rewards Credit Card gives you 1.5% cash back on every purchase. You also get the peace of mind knowing no one is messing around with your credit with the $0 Fraud Liability feature. However, you need to have $200 on hand as a deposit to qualify for the initial credit limit.

Features

- $0 Fraud Liability

- CreditWise enables you to monitor your credit score

- The deposit can be refunded with responsible card use

- 1.5% cash back on every purchase

APR

- 27.24% variable APR

Annual Fee

- None

Rating

This credit builder credit card has earned a 4.5 on our books. It has a reasonable security deposit that you can get back when you pay your credit card dues on time. The 1.5% cash back on every purchase also sounds like a sweet deal on top of being able to build your credit score.

Chase Freedom Student Credit Card

Not all credit builder cards are for people with bad credit. If you’re still young and want to build your credit, Chase offers the Freedom Student Credit Card. This is an awesome starter card with a 0% annual fee. However, not all students can qualify, as you’ll need to hold a part-time job for proof of income.

Features

- $20 good standing rewards after each account anniversary up until five years

- Credit limit increase with responsible use

- Access to a free credit score report through Credit Journey

- No annual fee

APR

- 14.99% variable APR

Annual Fee

- None

Rating

We give this card a rating of 3.0. It’s a good starter card for when you want to build your credit. However, unlike other credit cards, it doesn’t have the perks of an introductory APR. However, free real-time access to your credit score sounds like a sweet deal.

Citi Secured Mastercard

You can apply for a credit builder card with the Citi Secured Mastercard. For an initial security deposit of $200, you get the same amount in credit limit, as long as you pass the qualifications, that is. Citi reports to all three credit bureaus, so you can get a head start on building your credit.

Features

- Access to your FICO score online

- Flexible payment due dates

- Manage your account online

- No maintenance fees

APR

- 22.74% variable APR

Annual Fee

- None

Rating

We give the Citi Secured Mastercard a rating of 3.5. This credit card will help you build your credit score, but the APR is slightly high.

First Progress Secured Mastercard

How does the sound of “no credit check” sound? First Progress Secured Mastercard helps build your credit without looking into your credit history. You simply need to have an active account with Synovus, and then you’re all set. The low APR sounds like a good deal that makes you wonder if there’s more than meets the eye for this credit card.

Features

- Potential secured credit limit increase for up to $5000

- Credit reporting to all three credit bureaus

- Acceptable in all terminals that accept Mastercard

- Application won’t affect your credit score

APR

- 9.99% variable APR

Annual Fee

- $49

Rating

This credit card earned a 2.0 rating for us. It has an expensive annual fee and doesn’t offer much in terms of rewards. The APR sounds good, especially for someone just building their credit.

Know a Friend With Bad Credit?

Now that you know our top ten picks for credit builder cards, you can work on improving your credit score so you can finally get approved for that new car you’ve always wanted! Bad credit will only remain bad if you don’t do something about it. With a credit builder card, you can build up your credit- one purchase at a time.

If you know someone who has bad credit, don’t let them waste their time with boring credit card builders reviews! Throw them a bone and share this article with them. Don’t keep the good stuff to yourself!