So I was waiting for the train the other day and just found myself staring at this American Express credit card advert on the opposite wall.

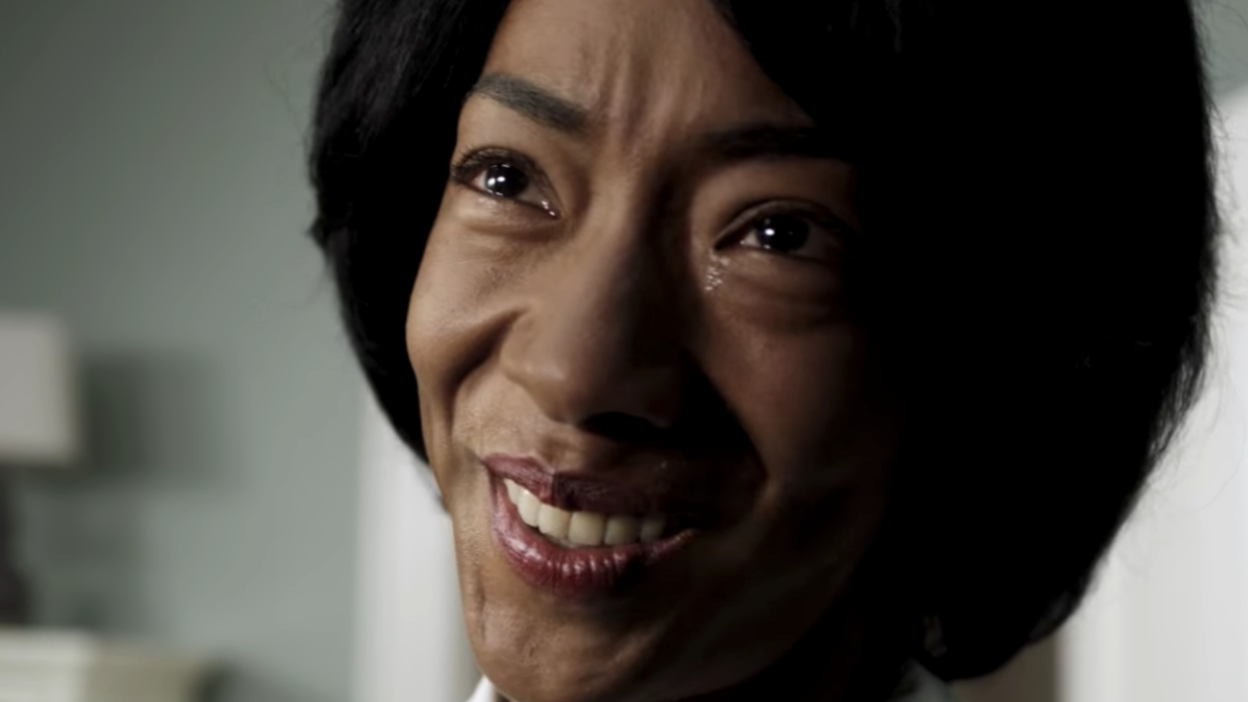

The people in the advert were attractive and they looked like they were having fun. But something seemed off. Off like the lead character in the film Get Out. Off off!

I realised it was the 60% APR that came with this little plastic rectangle nightmare.

60% representative APR….if you miss one single payment, you’ll end up in a world of financial trouble. In some other personal finance pieces on this website I’ve called this the debt trap.

You probably think i’m joking so i’ve found a little picture of a similar advert and popped it below:

So the team & I decided to create a little dummies guide to APR for personal finance.

In it we’ll cover credit card APR, loan APR, mortgage APR and everything in between, but before we get started…f**ck any company who charges you 60% APR for a credit card!

Quick Links to Useful Sections

- What is APR?

- Different Types of APRs

- Credit Card APRs

- Bank Loan APRs

- Mortgage APRs

- How are Different APR Rates Decided?

- APR Rates for High Credit Scores

- What is a Good APR Rate?

- APR Rate for Low Credit Scores

- What is a Bad APR Rate?

- What is 0% APR?

- What is a Grace Period?

- What is an Introductory APR?

- What is the Life of The Loan?

- What Are Annual Fees?

- What is the Daily Periodic Rate?

- What Are Late Payments?

- What Are Cash Advances?

- Everything You Need to Know About How APR Works

What The Hell is APR? Dummies Guide to APR for Personal Finance Table of Contents

How are Different APR Rates Decided?

What is APR?

You’ve probably seen the word APR floating about in your day to day life. It is just the short form of the term Annual Percentage Rate.

Annual percentage rate is the amount of yearly interest you will have to pay for any amount of money you have borrowed.

APR always represents the yearly cost of borrowing money, if you borrow money for a shorter period you will pay less (sometimes).

Financial institutions have to show how much APR they will charge you if you borrow money from them. This is so you can clearly understand what you are committing to and gives you a chance to compare offers from different companies.

Financial lenders can also advertise the interest rates they charge on a monthly basis before they show you their APR. So make sure you read the fine print of any credit agreement before you start dreaming about how you’ll be spending the money.

Always check the card’s terms when taking out a new credit card.

Different Types of APRs

There are lots of different types of APR, and they work in slightly different ways for each financial product. This is what makes borrowing money so confusing.

In this section we’ll give an overview of each of the different types of APR and how they are calculated.

Credit Card APRs

There are quite a few different transaction types you can make with your credit card, you can purchase something, request a cash advance (cash back) and even request a balance transfer to another credit card.

Each of these credit card transaction types will have a different APR.

This is why it’s always good to think about what you’ll be using your credit card for before applying for one, then pick the best credit card for that situation.

We have a whole blog post that can guide you through this decision – The Best Credit Cards for Every Life Situation.

Oh and if you miss a payment on your credit card or make a late payment you will usually be charged high-rate penalty APRs.

You’ve got to be careful, credit card companies are geniuses.

Bank Loan APRs

Next up, let’s decode the world of bank loans and their Annual Percentage Rates (APR). Spoiler alert: It’s a lot simpler than the rollercoaster ride of credit card APRs. Buckle up as we take a look at the two types of APR commonly featured in bank loans – the Fixed APR and Variable APR.

First stop, the Fixed APR. Imagine it as your steady, reliable buddy. With this type, the interest rate is a constant companion throughout the term of your loan. No surprises here. It’s like going on a road trip with a trusty old map. You know the route and exactly what lies ahead.

On the flip side, we have the Variable APR. This one’s a bit of a thrill-seeker. The interest on your loan fluctuates over time, akin to an adventurous road trip with multiple spontaneous detours. One month the interest may hike up, while the next, it could dip low.

There you have it! Navigating the world of APR on bank loans can be as simple as understanding the difference between a steady cruise and a spontaneous road trip. Choose wisely, my friends!

Mortgage APRs

There is a lot to mortgage APR. The APR offered by mortgages lenders usually contains:

- The interest rate you will be paying on the money you have borrowed. This is usually called your mortgage interest charges.

- Fees payable to the company you have borrowed the money from

- Other charges that you have agreed to in the mortgage agreement that you probably didn’t read

- Points, which are a discount on the closing costs of your mortgage in return for accepting a higher interest rate. Sounds a bit like short-term thinking to me!

How are Different APR Rates Decided?

Your credit report and credit score play a huge role in the amount of APR you are charged for borrowing money.

A credit card issuer, mortgage lender or personal loan provider will look at your credit score before deciding to lend you money.

APR Rates for High Credit Scores

If you have a high credit score you will usually be given the lowest interest rates:

- Low APRs

- Low fees

- Introductory APR offers

- Cash advances

- Balance transfers

- Prime rate offers

What is a Good APR Rate?

A good APR rate for a credit card is any from 14% and below. If you see a credit card offering you a credit card with APR in this range you’re onto a winner. You’re living the lower interest rate dream.

APR Rate for Low Credit Scores

If you have a low credit score, you’ll usually be charged really high interest rates.

This can happen if you have made some bad financial decisions, such as missed student loans payments, have defaults on your credit file or if you have an existing credit card debt on your credit history.

You’ll struggle to get any good credit card deals and likely will miss out on some of the best credit card deals.

It’s really likely that you will be offered a ‘credit builder credit card’. They are good first steps on your way to improving your credit score.

What is a Bad APR Rate?

A bad APR rate for a credit card is anything over 14%, if you focus on improving your credit score you could get access to some prime rate credit card offers.

What is 0% APR?

If you’ve got a good credit score, you might be offered a 0% credit card or a 0% loan for a certain period of time. This is usually for a year, we call this the introductory period.

In this introductory period you won’t see any interest charges on your monthly statement at the end of each billing period.

For some other types of new purchases such as car loans, auto loans, furniture and appliance purchases you might also be offered a 0% apr line of credit.

Always be a little sceptical of 0% apr deals on new purchases as you usually don’t get the best deal on the actual price of the thing you are trying to buy.

It’s a lot harder to negotiate a price if you are not paying in cash or upfront.

The lender usually discreetly adds a bunch of additional fees to the total price you’ll be paying for your 0% APR bargain:

- An origination fees

- Higher APR, interest charges & late payment fees as a penalty if you miss any payments throughout the life of your loan

What is a Grace Period?

Grace periods are really common with credit cards. A grace period is the time a credit card company gives you to pay off your monthly statement before they start charging you interest on the balance.

The grace period on a credit card is usually 21 days, but make sure you check the terms for your credit card, so you are clear on the grace period that you have to work with.

What is an Introductory APR?

With some credit cards, personal loans and auto loans, you are offered an introductory APR deal. This gives you a lower APR rate on the amount you have borrowed for a set period of time.

Sometimes you can be offered an introductory rate as low as 0% which is a pretty great deal. Just make sure you read the fine print of your credit card terms, as this introductory rate could only apply to some types of transactions.

Some transactions like balance transfers and cash advances may have different aprs.

What is the Life of The Loan?

The life of a loan is the duration you have agreed to borrow money for. Sometimes this is called the term of the loan.

If you have a loan with a fixed interest rate, you will be paying the same amount of interest for the life of the loan.

If you have a loan with a variable interest rate, the amount of interest you pay may vary throughout the life of the loan.

What Are Annual Fees?

Some credit cards charge annual fees for you to use them. You will usually find that exclusive credit cards with great offers and benefits may charge you an annual fee.

On the other end of the spectrum people with lower credit scores, may find that some credit builder credit cards with higher interest rates will also charge them annual fees.

Sometimes these annual fees are broken down into monthly payments and are charged alongside lender chargers (interest on money borrowed).

What is the Daily Periodic Rate?

Some credit card companies use the daily periodic rate to calculate how much interest you owe them and to sometimes maximise the amount of money they make from you as a customer.

The daily periodic interest rate is used to calculate interest due by multiplying the interest rate by the amount you owe at the end of each day.

This amount is then added to the credit card balance from yesterday and compounds until the end of the month.

What Are Late Payments?

Late payments are any payments that you make to a lender after the due date on your monthly statement.

Try your hardest not to make a late payment on any of your credit accounts as it can lower your credit score and end up leaving a default on your credit report.

What Are Cash Advances?

A cash advance is just a short term loan offer by your credit card company, allowing you to immediately withdraw cash from your current credit card balance.

There is usually higher apr on cash advances, so only use it when you are really strapped for cash.

Everything You Need to Know About How APR Works

So this little guide to APR should cover pretty much everything you need to know about the APR on credit cards, personal loans, mortgages and car loans.

Make sure you share this guide with a friend to make sure they don’t get screwed over by a 0% APR bargain and end up in a debt-trap.