If you’ve got no credit history or a poor credit score, the Tomo Credit Card by TomoCredit might just be perfect for you.

It has been designed to help you build a credit history without getting into any debt at all. This is because it doesn’t allow you to carry a monthly balance, which means you won’t have to pay any credit card interest at the end of the month. It kind of works like a charge card, as you are not charged an interest rate on the money you borrow.

We’ve put together the ultimate Tomo Credit Card review telling you everything you need to know about the Tomo Credit Card.

Quick Links to Useful Sections

Tomo Credit Card Review: Everything You Need to Know in 2025 Table of Contents

Tomo Credit Card Review Table of Contents

Tomo Credit Card Review at a Glance

Who is The Tomo Credit Card Perfect For?

How to Use Tomo Credit Card for Maximum Value

What is the Tomo Credit Card Applications Process?

Is Tomo Credit Card a Visa or Mastercard?

What APR Does the Tomo Credit Card Have?

What Credit Reference Agencies Does the Tomo Credit Card Report to?

Does the Tomo Credit Card Have any Reviews?

Does the Tomo Credit Card Have Any Any Annual Fees?

Will Applying for the Tomo Credit Card Affect My Credit Score?

What Credit Limit Does The Tomo Credit Card Offer?

So, How Does the Tomo Credit Card Team Make Money?

Can I Get a Credit Limit Increase With a Tomo Credit Card?

How to Use the Tomo Credit Card to Build Your Credit Score?

Does The Tomo Credit Card Have Automated Payment Options?

What is The Tomo Credit Card App?

How Do I Contact Tomo Credit Card Customer Service?

How Does Tomo Check If I Am Eligibile for Their Credit Card?

Does The Tomo Credit Card Require a Security Deposit?

Does The The Tomo Credit Card Offer Emergency Assistance?

What Are The Benefits of The Tomo Credit Card?

Tomo Credit Card Review Table of Contents

Tomo Credit Card Review at a Glance

Who is The Tomo Credit Card Perfect For?

How to Use Tomo Credit Card for Maximum Value

What is the Tomo Credit Card Applications Process?

Is Tomo Credit Card a Visa or Mastercard?

What APR Does the Tomo Credit Card Have?

What Credit Reference Agencies Does the Tomo Credit Card Report to?

Does the Tomo Credit Card Have any Reviews?

Does the Tomo Credit Card Have Any Any Annual Fees?

Will Applying for the Tomo Credit Card Affect My Credit Score?

What Credit Limit Does The Tomo Credit Card Offer?

So, How Does the Tomo Credit Card Team Make Money?

Can I Get a Credit Limit Increase With a Tomo Credit Card?

Is a Good Credit Score & Credit History Required for a Tomo Credit Card?

How to Use the Tomo Credit Card to Build Your Credit Score?

Does The Tomo Credit Card Have Automated Payment Options?

What is The Tomo Credit Card App?

How Do I Contact Tomo Credit Card Customer Service?

How Does Tomo Check If I Am Eligibile for Their Credit Card?

Does The Tomo Credit Card Require a Security Deposit?

Does The The Tomo Credit Card Offer Emergency Assistance?

What Are The Benefits of The Tomo Credit Card?

What is The Preapproval Process for the Tomo Card?

What are Some of The Disadvantages of the Tomo Credit Card?

Tomo Credit Card Review at a Glance

In this section of our Tomo Credit Card review you will get a quick summary of everything you need to know about this popular credit builder credit card.

- The Tomo Credit Card has no APR Charges

- You will not be charged an annual fee for using the Tomo Credit Card

- You must share your financial information with Tomo

- You can earn up to a 1% cashback

Who is The Tomo Credit Card Perfect For?

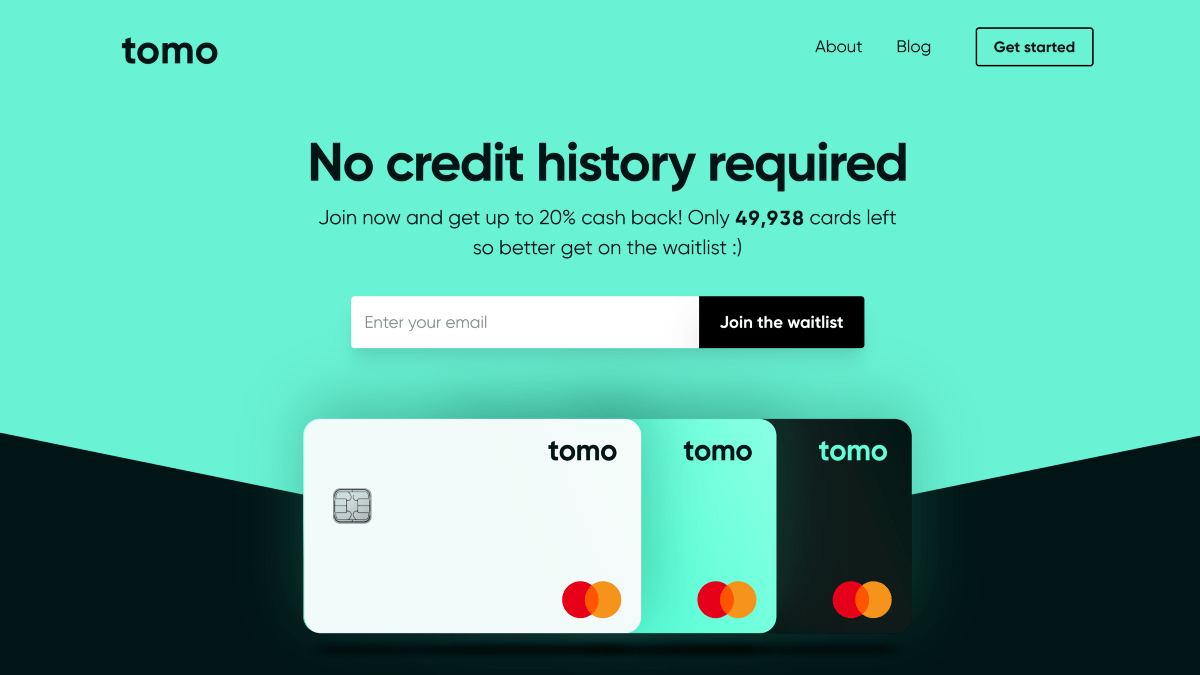

If you are looking for your first credit card or if you have poor credit, the Tomo Credit Card is perfect for you. The TomoCredit team doesn't do the usual hard credit searches like other credit card issuers.

Tomo looks at your checking and savings account to approve you for a Tomo Credit Card and to set your new credit limit.

This makes it ideal for students, young adults, graduates, immigrants and anyone looking for a credit card without the usual hassle and fuss you get from the big banks & financial institutions.

The great thing about the Tomo Credit Card is that it provides monthly reports to the three major credit bureaus, slowly building your credit score and improving your credit report the more you use it.

How to Use Tomo Credit Card for Maximum Value

The Tomo Credit Card gives you 1% cashback on every single purchase that you make using the card. So, it makes sense for you to use the Tomo Credit cards as the day-to-day card that you use for all your purchases, sometimes we call this your primary card.

Another reason to use the Tomo Credit Card as your primary card, rather than your debit card is because it provides credit reports to the three major credit bureaus every month (Equifax, Experian & TransUnion).

This means that every month the Tomo Credit Card can improve your credit score and credit history. It works like a secured credit card without you putting down any collateral.

What is the Tomo Credit Card Applications Process?

The application process for the Tomo Credit Card is really straightforward, the most important part is for you to link your checking or saving account with TomoCredit during your application.

There are some unsupported institutions that TomoCredit can’t link to during the application process, but they can link to most checking, savings, asset and investment accounts.

The more accounts you link to, the higher your Tomo Credit Card limit will be.

To apply for a Tomo Credit Card, you just need to:

- Head to the Tomo Credit Card Website: Here

- Enter your email address

- Check your email inbox for the application link

- Complete the Tomo Credit Card Application - The Tomo card does not do a credit check like traditional credit cards or secured credit cards

- Provide your social security number - You need to be U.S. Citizen to get a Tomo Credit Card

- Link your checking, savings, asset and investments account to TomoCredit - the team will check your current bank account balance - You will have to provide an automatic payment schedule banking information. Also if you link more accounts, TomoCredit gives you a high credit limit

- Get your Tomo Credit Card approval

- Wait 3-5 working days for your new Credit Card to arrive

Is Tomo Credit Card a Visa or Mastercard?

The Tomo Credit Card runs on the Mastercard payment network. On the Mastercard network you get quite a few benefits when you use the credit card, including:

Emergency Cash

Have you ever been in a pickle, cash-wise? Maybe you're stranded in a foreign city after a series of unfortunate events, your wallet, gone. Or maybe you’ve experienced a sudden expense, and your savings are just about as dry as the Sahara. It feels like the end of the world, doesn't it? Well, this is where Mastercard Global Service swoops in like a financial superhero, to save the day!

Picture this: a lifeline that's accessible worldwide, an aid when things look bleak. That's what the Mastercard Global Service offers. In those hairy situations, when you're cash-strapped, and the pressure's building, you can tap into an emergency card or snag a quick cash advance. This isn't about lavish spending or funding your next impromptu shopping spree; it's a safety net for when you're in a tight corner, offering a little help to get you back on your feet.

Imagine having the comfort of knowing that even in the direst circumstances, a backup is waiting. A small cash injection to tide you over or an emergency card to fill in until your regular one's back in action. That's the beauty of the Mastercard Global Service. It's the pinch hitter when you're down and out, it’s the tiny spark of hope in the darkest hour.

So next time you're in a jam, remember, with Mastercard Global Service, you're not alone. You've got a pocket-sized guardian angel, ready to step in when the going gets tough. It's like having a financial safety net, wherever you are, whenever you need it. Now, how's that for peace of mind?

Theft Protection

With the Mastercard ID Theft Protection Service, you get alerts every time there is suspicious activity like someone randomly using your card to place online bets on a UFC fight.

Authorized Usage Cover

If anyone uses your credit card to make an unauthorised payment you will not be responsible for any of the purchases on your card.

What APR Does the Tomo Credit Card Have?

The Tomo Credit Card has no annual percentage rate. It charges no APR as it doesn’t allow you to carry a balance into the next month.

It does this through its auto-payment feature that ensures you pay your credit card balance in full at the end of every month or every week.

You essentially get 7-30 days worth of credit, this is perfect for helping you manage your cash flow and stops you from needing to take out payday loans or any other type of high interest short term loan.

The TomoCredit team will set you up with either monthly payments or weekly payments, you will not be charged any late payments.

What Credit Reference Agencies Does the Tomo Credit Card Report to?

The Tomo Credit Card reports to all three major credit bureaus:

- Equifax

- Experian

- TransUnion

If you use your Tomo Credit Card responsibly, your credit score can improve as the TomoCredit team will report a positive credit history for your account with them.

Does the Tomo Credit Card Have any Reviews?

The online reviews for the Tomo Credit are not great, quite frankly they are disappointing.

One Tomo Credit Card review even says, “This company is a huge disappointment”.

Here is one Tomo Credit Card Review from TrustPilot:

This company is a huge disappointment. They shut down their Google Business account because it had dozens of 1-star reviews with testimonials - that should tell you they are AWARE, and instead of fixing their issues, they want to hide them. As others have said, they have zero customer service. However, the actions they take as a "bank" are horrendous. Kristy Kim is the next Elizabeth Holmes; let's all sit back and watch. This bank will lock your card if you are late on your payment, even without a default; if you filed a dispute, even if you're not at fault, such as fraud; if you so much as use the card in any way that isn't a straight-forward purchase. After locking, it will take you weeks to unlock, and when you raise the issue with them, they say, "we aren't like other banks." I had my card fraudulently used after my wallet was stolen from a car break-in, and they refused to credit the amount disputed, in fact, it's been five months since they began investigating and they still haven't provided a resolution. What other bank takes five months to investigate a dispute? I'm eagerly searching them online daily and waiting for one of the many angry customers to bring forward a lawsuit so that their shady practices are exposed. If you're considering this card, I will caution - if you can get anything else, do so; there are plenty of legitimate ways to build good credit out there like Self without the need of this painful experience.

We recommend you always do deeper reviews into any credit card company. Bad credit card reviews will always usually be left by the most upset and angry customers, so make sure you take them into account but do not let them say your decision to use the Tomo Credit Card, because hey…it’s free anyway.

Does the Tomo Credit Card Have Any Any Annual Fees?

The great thing about the Tomo Credit card, is that it doesn’t have any annual fees like some of the other credit builder cards offered by other Credit Unions. There is also no monthly fee like some of the major banks charge.

Alongside having no annual fees, the Tomo Credit doesn't have any credit card fees, no late fees and charges no APR. Too good to be true…nope, it’s exactly the way things should be.

Will Applying for the Tomo Credit Card Affect My Credit Score?

No, the Tomo Credit Card will not affect your credit score as it allows anyone to apply for it without a credit history. The team behind the Tomo Credit card have found a way to check your eligibility without looking at your credit score, this means they don’t make a credit pull to check your FICO score.

They just need access to your checking and saving account to double check you are financially responsible and to assign your credit limit.

What Credit Limit Does The Tomo Credit Card Offer?

The great thing about the Tomo Credit card is that it can offer you a credit limit of up to $10,000, with no credit checks, no APR and no extra fees. Yep, you can get up to a $10,000 credit line. Sounds crazy right? It’s what you get when a technology company partners with a legacy bank!

So, How Does the Tomo Credit Card Team Make Money?

The Tomo Credit Card team makes money through something called interchange fees, this is a fee shared with Mastercard and the issuing bank every time you use your Tomo Credit Card at a shop (merchant).

Can I Get a Credit Limit Increase With a Tomo Credit Card?

Yes, you can get a credit limit increase on your Tomo Credit Card. You will need to have made all of your payments on time for the last three months to be eligible and there is no guarantee you will receive an increase but it’s definitely worth a try!

To request a credit limit increase, simply log into the Tomo Credit Card app and go to the ‘credit limits’ tab, from here you can click ‘request an increase.’

Is a Good Credit Score & Credit History Required for a Tomo Credit Card?

No, you do not need to have a good credit score or credit history to be eligible for the Tomo Credit Card. This is one of the main reasons people love this card! It’s perfect for those who are looking to build their credit score or establish a credit history.

The Tomo Credit Card is also great for people with bad credit as it offers the opportunity to improve your credit score by making all of your payments on time and keeping your balance low.

How to Use the Tomo Credit Card to Build Your Credit Score?

There are a few things you can do to use the Tomo Credit Card to build your credit score:

- Use your Tomo Credit Card regularly and make sure you always make at least the minimum payment on time to avoid late fees. Frequent payments build credit scores.

- Try to keep your balance low, this shows lenders that you can manage your credit responsibly and may help to increase your credit limit.

- Use the Tomo Credit Card app to track your progress and see how your payments are affecting your credit score.

Does The Tomo Credit Card Have Automated Payment Options?

Yes, the Tomo Credit Card has automated payment options so you can make sure your payments are always on time. You can set up automatic payments in the Tomo Credit Card app under the ‘payments’ tab. This will ensure payments are automatically deducted from your linked bank account.

What is The Tomo Credit Card App?

The Tomo Credit Card app is a free mobile application that allows you to manage your account, make payments, request credit limit increases and track your credit score progress.

The app is available on both iOS and Android devices and can be downloaded from the App Store or Google Play Store.

How Do I Contact Tomo Credit Card Customer Service?

If you need to contact Tomo Credit Card customer service, you can do so by emailing support@tomocredit.com or by calling (855) 266-8465.

You can also reach out to the Tomo Credit Card team on social media, they are active on both Twitter and Facebook.

The Tomo Credit Card is a great option for those who are looking to build their credit score or establish a credit history.

How Does Tomo Check If I Am Eligibile for Their Credit Card?

The team behind the Tomo Credit Card have found a way to determine eligibility without looking at your credit score, which means they don’t make a credit pull to check your FICO score. You can get up to a $100,000 credit line with no APR and no extra fees.

The Tomo Credit Card team makes money through something called interchange fees, this is a fee shared with Mastercard and the issuing bank every time you use your Tomo Credit Card at a shop (merchant).

Does The Tomo Credit Card Require a Security Deposit?

No, the Tomo Credit Card does not require a security deposit.

Does The The Tomo Credit Card Offer Emergency Assistance?

No, the Tomo Credit Card does not offer emergency assistance. However, they do offer a wide range of other benefits and features that can help you in case of an emergency. For example, the Tomo Credit Card offers automated payment options so you can make sure your payments are always on time. You can also set up automatic payments in the Tomo Credit Card app under the ‘payments’ tab to ensure payments are automatically deducted from your linked bank account. Additionally, the Tomo Credit Card team is active on both Twitter and Facebook if you need to reach out to them for any reason.

What Are The Benefits of The Tomo Credit Card?

Some of the benefits of the Tomo Credit Card include no credit pull to check your FICO score, no APR, and no extra fees. You can also get up to a $100,000 credit line with the Tomo Credit Card. Additionally, the Tomo Credit Card offers automated payment options and the ability to track your credit score progress in the Tomo Credit Card app.

What is The Preapproval Process for the Tomo Card?

The preapproval process for the Tomo Card is quick and easy. You can check your eligibility without a credit pull by providing some basic information about yourself. Once you’re preapproved, you can get up to a $100,000 credit line with no APR and no extra fees.

What are Some of The Disadvantages of the Tomo Credit Card?

Some of the disadvantages of the Tomo Credit Card include the fact that they don’t offer emergency assistance and there is no grace period for late payments. Additionally, if you miss a payment, you will be charged a late fee. However, these fees are relatively low when compared to other credit cards on the market.