Imagine a world where your credit score doesn’t define your future—where finding the perfect loan with less-than-stellar credit is as smooth as scrolling through your favorite social feed. Welcome to 2025, the era of innovation, empowerment, and financial resilience. Whether you’re a millennial hustling for that next big opportunity or a Gen Z trailblazer searching for a fresh start, this guide is your ultimate resource for uncovering the best loans for bad credit. We’re about to dive into a financial playbook that blends humor with hard facts, practical advice with inspiring success stories, and the latest trends with timeless wisdom. Buckle up, because your journey to better financial health starts right now!

Best Loans for Bad Credit in 2025 Table of Contents

Understanding Bad Credit Loans in 2025: New Realities and Fresh Opportunities

Breaking Down the Types of Loans for Bad Credit

How Lenders Are Rethinking Bad Credit in 2025

The Best Loan Options for Bad Credit in 2025

Key Features to Consider When Choosing a Loan

Expert Tips for Navigating the Bad Credit Loan Landscape

Leveraging Technology to Enhance Your Loan Experience

Building a Support Network: Resources and Community Support: Your Next Steps

Real-Life Success Stories: Inspiring Journeys to Financial Freedom

Steps to Prepare Yourself for a Successful Loan Application

Embracing a New Financial Perspective: Beyond Just a Loan

Frequently Asked Questions About the Best Loans for Bad Credit in 2025

Understanding Bad Credit Loans in 2025: New Realities and Fresh Opportunities

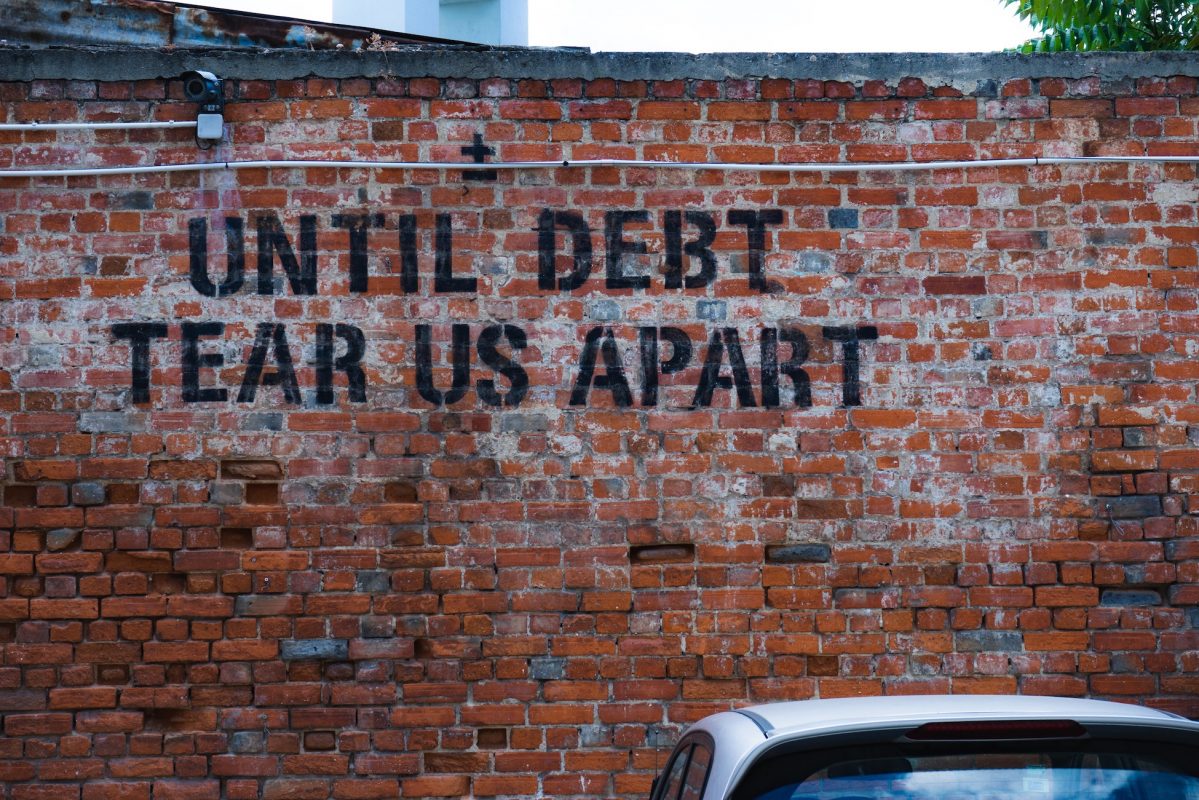

Let’s face it—life happens, and sometimes our credit scores take a hit. Whether it’s unexpected expenses, job transitions, or those “oops” moments we all experience, bad credit can feel like a brick wall blocking your financial dreams. But here’s the twist: in 2025, the financial landscape has evolved dramatically, offering innovative and flexible loan options designed specifically for those who have faced credit challenges.

At its core, a bad credit loan is simply a loan offered to individuals whose credit history isn’t pristine. Traditionally, bad credit meant sky-high interest rates, prepayment penalties, and a boatload of red tape. Today, however, lenders understand that credit scores are just one piece of your financial story. New digital platforms, community-based lenders, and specially designed financial products are breaking the mold—helping you secure the funds you need without the judgment or hassle of old-school banks.

In 2025, the philosophy behind bad credit loans is all about inclusivity, transparency, and empowerment. Whether you’re looking to consolidate debt, cover an emergency expense, or invest in your future, there’s a loan option tailored just for you.

Breaking Down the Types of Loans for Bad Credit

Before diving into the best options, it’s key to understand the different types of loans available. Here’s a quick overview:

- Personal Loans: Versatile and widely available, personal loans can be used for almost anything—from home renovations to paying off lingering debts. These loans typically have fixed interest rates and repayment terms, making budgeting easier.

- Installment Loans: Structured over a set period, these loans allow you to make manageable monthly payments. They’re ideal if you prefer predictable budgeting.

- Secured Loans: Backed by collateral, secured loans often come with lower interest rates. While these might sound intimidating, items like a car or savings account can serve as collateral to secure better terms.

- Online and Peer-to-Peer Lending: The digital revolution has spurred lending platforms that match borrowers with investors. These innovative models offer competitive rates and more lenient approval criteria.

- Payday Alternative Loans (PALs): Offered by credit unions, these loans provide a safer, more affordable alternative to payday loans, with lower fees and interest rates.

Each of these options comes with its own set of pros and cons depending on your personal finances, treatment by creditors in the past, and current financial goals. In the sections that follow, we’ll break down the nuances of each so you can confidently decide which loan type is right for you.

How Lenders Are Rethinking Bad Credit in 2025

Gone are the days when a low credit score was an automatic deal-breaker. In 2025, lenders are putting the entire picture of your financial life under the microscope. They’re asking: Who are you beyond the numbers on your credit report? With the integration of alternative data and advanced analytics, lenders are now considering factors such as:

- Income Stability: Regular paychecks, freelance income, or even side hustles can all paint a picture of financial reliability.

- Employment History: A stable work history is often seen as a sign of responsibility and resilience, even if your credit track record isn’t immaculate.

- Banking Activity: Demonstrating a pattern of regular savings, bill payments, and financial discipline can work wonders when lenders dig deeper.

- Educational Background and Life Experience: Believe it or not, some modern lenders consider your potential future earnings based on your education, career trajectory, and even your willingness to learn from past mistakes.

This holistic approach means that while your credit score is still important, it doesn’t have to be a prison sentence. Instead, it’s one part of your financial identity—a part that can be improved with the right support and strategy.

The Best Loan Options for Bad Credit in 2025

Now comes the million-dollar question: Which loans should you consider if you’ve got bad credit? We’ve sifted through the noise to bring you the top choices that combine accessibility, fair terms, and user-friendly application processes.

Personal Loans Tailored to You

Personal loans remain a favorite for many, and for good reason—they offer flexibility and fixed repayment terms that help you manage your monthly budget. In 2025, many lenders now offer personal loans specifically designed for borrowers with bad credit. These loans often come with the following benefits:

- Predictable Payments: With fixed interest rates and structured repayment plans, you know exactly what to expect each month.

- Quick Approval: Thanks to automated underwriting processes, you can receive funding in as little as 24 hours.

- No Collateral Required: Many personal loans for bad credit are unsecured, meaning you don’t have to risk your assets.

Top contenders include specialized online lenders that focus on helping individuals rebuild their credit while managing immediate financial needs.

Online Lending Platforms: Speed, Simplicity, and Smarts

The rise of fintech has transformed the borrowing experience. Online lending platforms are thriving in 2025, offering an intuitive, streamlined application process that goes digital from start to finish. These platforms often use alternative metrics—like cash flow analysis and social media profiles—to assess your creditworthiness.

The advantages of these platforms are clear:

- Digital Convenience: Apply from anywhere, at any time, using your mobile device.

- Transparent Terms: With clear, easy-to-read loan details, there are no nasty surprises down the line.

- Community Reviews: User feedback and community ratings help you gauge the reliability of lenders before signing up.

Whether you’re looking for a quick personal loan or a more substantial amount, these platforms are redefining what it means to borrow in the digital age.

Credit Union Loans: The Local Advantage

Sometimes, the best solutions are found in your local community. Credit unions have long been bastions of trust and support, especially for those who have struggled with traditional banks. In 2025, many credit unions offer bad credit loans that are both affordable and adaptable to your unique financial situation.

Here’s why credit union loans are worth a look:

- Member-Centric Philosophy: Unlike big banks, credit unions operate on a not-for-profit basis, meaning profits are reinvested into lower rates and better terms for members.

- Personalized Service: Expect a human touch and tailored advice when navigating your loan options.

- Flexibility: Credit unions are often more willing to work with members who have had credit bumps along the way.

If you’re looking for a supportive, community-driven alternative to mainstream banks, credit unions have you covered.

Peer-to-Peer (P2P) Lending: A Modern Twist on Social Finance

Peer-to-peer lending is another exciting development that empowers borrowers by connecting them directly with individual investors. This model bypasses traditional lending institutions, offering competitive interest rates and a more streamlined approval process—especially for those with less-than-perfect credit.

The benefits of P2P lending include:

- Competitive Rates: Direct competition among investors can drive down interest costs.

- Faster Funding: With less bureaucracy, you can secure funds quickly to address your immediate needs.

- Community Involvement: Borrowers and investors form a unique, mutually supportive financial network.

If you like the idea of turning to a community of investors instead of traditional banks, peer-to-peer lending might be just the right fit for your financial goals.

Payday Alternative Loans (PALs): The Smart Rescue Option

Let’s talk about those dreaded payday loans: notorious for their high fees and hidden costs. In contrast, Payday Alternative Loans (PALs) provided by many credit unions offer a much smarter rescue option. PALs are designed to give you quick access to cash without the astronomical interest rates that come with typical payday loans.

Here’s what sets PALs apart:

- Lower Fees: Say goodbye to sky-high interest rates and fees that deepen financial woes.

- Transparent Terms: Clear repayment plans that help you budget your way out of any temporary financial crunch.

- Member Benefits: Offered by credit unions, PALs come with the added support of a community that believes in second chances.

PALs are for those who need a fast solution that won’t damage their financial future further.

Key Features to Consider When Choosing a Loan

With a myriad of options available in 2025, selecting the best loan for your situation may seem overwhelming. Here are some critical features to help you compare your options:

- Interest Rates: Look for loans with competitive, transparent interest rates. Lower rates mean less money spent in the long run.

- Repayment Terms: Consider the length of the loan and whether the monthly payments are manageable based on your current income and expenses.

- Application Process: The ideal lender should offer a streamlined, digital application process and clear criteria for approval.

- Fees and Penalties: Keep an eye out for hidden fees, prepayment penalties, or other charges that could increase the loan’s cost.

- Customer Service: A lender that values transparent communication and offers support throughout the loan process is invaluable.

- Flexibility and Alternatives: Some loans allow you to adjust payment due dates or provide a grace period in case of unexpected financial hiccups.

By keeping these factors in mind and comparing your options, you can find a loan that not only meets your immediate needs but also supports your long-term financial health.

Expert Tips for Navigating the Bad Credit Loan Landscape

Finding the perfect loan when you’ve got bad credit is as much an art as it is a science. Here are some insider tips and strategies to boost your chances and put you in a stronger negotiating position:

Build a Solid Financial Story

Even if your credit score isn’t stellar, you can still paint a picture of financial responsibility. Gather documentation that showcases your income stability, regular bill payments, and savings habits. This extra effort can tip the scales in your favor when lenders evaluate your application.

Shop Around Like You’re on a Treasure Hunt

Don’t settle for the first offer that comes your way—compare multiple lenders, both online and in your community. Each lender has its quirks, so take your time to assess which offers the best terms, lowest fees, and overall transparency.

Leverage Alternative Data

A growing number of lenders in 2025 are willing to look beyond the traditional credit score. If you’ve got a history of on-time utility payments, reliable rent payments, or even steady freelance income, be sure to highlight that information. It might just convince a lender that you’re creditworthy.

Stay Educated on Financial Wellness

The more you understand about managing debt, budgeting your income, and handling unexpected expenses, the better prepared you’ll be to choose the right loan. Empower yourself with financial literacy by leveraging online courses, community workshops, and trusted financial blogs.

Plan for a Brighter Financial Future

Securing a loan should not be just a quick fix—it’s an opportunity to rebuild your financial health. Use this period as a launchpad to improve your credit score over time. Make all your payments on time, reduce unnecessary spending, and consider consulting a financial advisor who can guide you on the path to credit recovery.

These expert tips are your secret weapons in a challenging financial landscape. With determination and the right strategy, you can transform today’s hurdles into tomorrow’s stepping stones.

Leveraging Technology to Enhance Your Loan Experience

In 2025, technology is your best friend when it comes to managing finances. From AI-driven loan applications to community forums that offer firsthand lender reviews, tech has revolutionized the borrowing experience for anyone with bad credit. Here’s how:

- Mobile Applications: Many lenders now offer user-friendly apps that let you apply, monitor, and manage your loan on-the-go. These apps integrate budgeting tools, payment reminders, and even chat support to guide you through the process.

- Data Analytics: Advanced algorithms analyze your financial habits and habits, helping lenders determine more accurate risk assessments—making it easier for you to get a fair loan regardless of your past credit bumps.

- Online Community Feedback: Websites and social media platforms provide reviews and testimonials from other borrowers. These insights can be invaluable when choosing a lender, as real-life experiences often reveal the hidden pros and cons of each option.

- Automated Financial Coaching: Some platforms now include financial wellness modules that guide you on budgeting, saving, and gradually improving your credit score through personalized plans.

By leveraging these technological innovations, not only do you streamline your loan application process, but you also empower yourself with tools to stay on top of your financial game.

Building a Support Network: Resources and Community Support: Your Next Steps

While understanding your loan options is crucial, navigating the world of bad credit financing can feel daunting without the right support system. In today’s interconnected world, there are numerous communities, resources, and experts eager to help you improve your financial well-being.

Start by checking out local non-profit credit counseling agencies, which offer free or low-cost advice tailored to your personal financial situation. Many community centers and libraries also host workshops on financial literacy—areas as diverse as budgeting basics, debt management, and even negotiating with creditors.

Don’t underestimate the power of online communities either. Platforms like Reddit, Facebook groups, and specialized personal finance blogs are treasure troves of real-life advice, success stories, and recommendations on trusted lenders. By joining these groups, you can share your journey, learn from others’ experiences, and gain personal insights on effective credit rebuilding strategies.

Additionally, many innovative lenders offer dedicated support teams that provide personalized guidance throughout your loan process. Whether you have questions about the application, need tips on credit management, or simply want reassurance along the way, there’s always someone ready to lend an ear and a helping hand.

Finally, consider taking advantage of free financial literacy courses available online. From budgeting apps that track your expenditure to virtual workshops on economic empowerment, these resources can equip you with the knowledge and confidence you need to build a stronger financial base—even if your credit history isn’t perfect.

Your next steps are all about crafting a robust support network that champions your financial health. Embrace these resources, keep learning, and remember: even the smallest change in your financial strategy can lead to huge improvements down the road.

Real-Life Success Stories: Inspiring Journeys to Financial Freedom

Sometimes, all it takes is a relatable success story to spark the motivation you need to make a change. Let’s explore a few real-life journeys where individuals turned their financial challenges into milestones of success:

The Comeback Kid

Meet Alex—a millennial who once struggled to get by due to a string of missed payments and credit mishaps. When Alex discovered a personal loan tailored for bad credit, it became the stepping stone for a complete financial turnaround. With the funds, Alex consolidated debts, started an emergency fund, and even embarked on a side hustle that gradually improved the credit score. Today, Alex’s story is a go-to example in online financial communities for how a well-chosen, manageable loan can pave the way to financial stability.

The Community Champion

Then there’s Jamie, a Gen Z entrepreneur who found support in a local credit union. After facing rejection from major banks, Jamie opted for a credit union loan designed to help rebuild credit. The personalized attention and community-driven approach not only provided Jamie with the necessary funds to expand a small business, but also offered ongoing financial advice that eventually led to a significant improvement in credit rating. Jamie’s journey highlights the power of leaning on community support and making smart, incremental financial decisions.

The Digital Trailblazer

Lastly, consider Taylor—a digital nomad who turned to online lending platforms after a series of unpredictable freelance income phases. With an innovative approach using a digital loan and budgeting app integration, Taylor managed to keep payments on track and gradually enhanced the credit profile. Today, Taylor is not only financially independent but also an advocate for digital financial tools that support those with fluctuating incomes.

These stories prove that with determination, smart decision-making, and the right resources, anyone can transform financial hurdles into opportunities for growth and success.

Steps to Prepare Yourself for a Successful Loan Application

Before you jump into the application process, a little homework can make all the difference. Here’s a step-by-step guide to ensure you’re perfectly primed for success:

Step 1: Audit Your Financial Health

Take an honest look at your income, debt, savings, and spending habits. Use free online tools to check your credit reports, and note areas where improvements can be made. A little self-awareness goes a long way toward building lender confidence.

Step 2: Organize Your Documentation

Gather proof of income, bank statements, and identification. The better prepared you are with the right paperwork, the smoother your application will go.

Step 3: Establish an Action Plan

Outline a realistic budget that includes your anticipated loan repayments. Consider how the loan fits into your overall financial goals—whether it’s to consolidate debt, cover an emergency, or invest in your future.

Step 4: Research and Compare Lenders

Use trusted online review sites, financial blogs, and community forums to compare different lenders. Look out for hidden fees, interest rate patterns, and terms that best match your financial profile.

Step 5: Seek Expert Advice

Don’t hesitate to reach out to a financial counselor or advisor if you have questions. Many non-profit organizations offer free consultations to help you chart a path toward better credit and stronger financial standing.

By following these preparatory steps, you not only improve your chances of getting approved but also set the stage for financial discipline and future credit repair.

Embracing a New Financial Perspective: Beyond Just a Loan

Securing a loan for bad credit in 2025 isn’t just about accessing funds—it’s about embracing a more holistic and forward-thinking approach to financial well-being. With every decision, from selecting a lender to managing repayments, you have the opportunity to redefine your relationship with money.

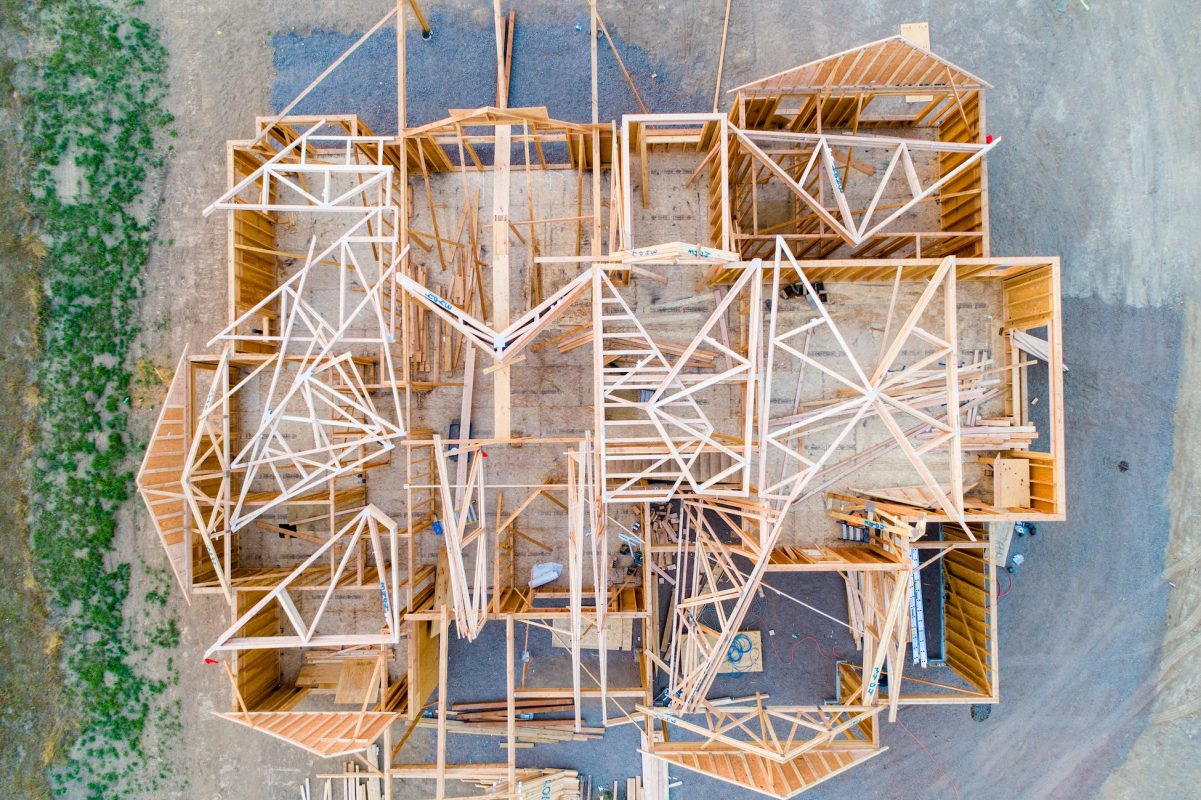

Think of this as a chance to build a resilient financial foundation. Each timely payment, budgeting app notification, and financial literacy article you read is a brick laid in the structure of your future prosperity. Rather than viewing loans as mere stop-gap solutions, see them as tools that, when used wisely, can catalyze a journey toward financial freedom and empowerment.

The financial landscape is evolving, and so are you. In a world that increasingly values second chances, every step you take today is a stride toward a brighter, more secure tomorrow.

Frequently Asked Questions About the Best Loans for Bad Credit in 2025

Here are some of the most common questions asked by borrowers, along with insightful answers to guide your journey:

1. What exactly qualifies as a bad credit loan?

A bad credit loan is designed for individuals whose credit scores fall below traditional lending standards. These loans might come with higher interest rates or different terms, but modern lenders often incorporate alternative data to offer more inclusive terms.

2. Are interest rates for bad credit loans significantly higher in 2025?

While interest rates can be higher when compared to prime loans, many lenders now offer competitive rates and transparent terms. By comparing your options and improving your financial profile over time, you can potentially secure lower rates.

3. How do online lending platforms evaluate my creditworthiness?

Online platforms typically combine traditional credit scores with alternative data like income consistency, payment history for bills, and even digital activity. This broader approach helps provide a more accurate picture of your financial health.

4. Can I improve my credit score while repaying a bad credit loan?

Absolutely. Making timely payments, managing your budget effectively, and using credit responsibly will contribute to credit score improvement over time. Some lenders even report your payments to credit bureaus, helping you rebuild your credit profile.

5. What should I do if my loan application gets rejected?

If you’re turned down, use the feedback as a learning opportunity. Evaluate your credit report for errors, work on paying down existing debt, and consider seeking professional advice. There are many lenders who specialize in second chances, so don’t lose heart.

6. Are credit unions the best option for bad credit loans?

Credit unions are a great option for many borrowers due to their community focus and favorable terms. However, the best option depends on your personal financial situation—make sure to explore all available options.

7. How quickly can I get approved for a loan with bad credit?

Many online lenders and digital platforms offer approvals within 24 to 48 hours. However, processing times may vary based on the lender and the complexity of your application.

8. What are the key benefits of peer-to-peer lending?

Peer-to-peer lending connects you directly with individual investors, often resulting in competitive interest rates and flexible terms that can be more lenient than traditional banks.

9. Should I consider a secured loan if I have bad credit?

If you have collateral (like a car or savings), a secured loan might offer lower interest rates. However, weighing the risk of losing collateral if payments aren’t maintained is crucial.

10. How can I avoid predatory lending practices?

Research the lender thoroughly, read reviews, and understand the fine print before signing any agreement. Favor lenders that are transparent and have a solid track record in helping borrowers rebuild their credit.

Your Journey to Financial Empowerment Starts Here

In a world that once neglected those with bad credit, 2025 stands as a beacon of hope for anyone ready to take control of their financial destiny. From innovative personal loans to the supportive embrace of credit unions and peer-to-peer lending, the options available now are built on the pillars of fairness, transparency, and empowerment.

Every step you take—whether it’s assessing your finances, comparing various lenders, or joining an online community of like-minded individuals—sends ripple effects toward a more secure and confident financial future. Remember, a loan is more than just a financial product; it’s a tool that, when used wisely and coupled with continuous learning, can transform financial stress into success.

As you digest this wealth of information and embark on your borrowing journey, empower yourself with diligence and optimism. The best loans for bad credit aren’t about masking the past; they’re about forging a future built on renewed financial responsibility and hope.

Ready to dive in? Take that leap, harness the power of innovative financial products, and celebrate every milestone along the way. Whether you’re repaying a loan or rebuilding your credit one step at a time, your journey to financial empowerment is uniquely yours. Here’s to smart choices, informed decisions, and the promise of a brighter, debt-savvy future!