Dreaming of the perfect smart home where your avocado toast is served by a robot barista and your plant-based, solar-powered kitchen comes with a view? In 2025, building your dream home might seem as futuristic as ordering food from a drone, but getting the right home construction loan can be an adventure in itself. Whether you're a savvy millennial or a Gen Z visionary plotting the blueprint for a sustainable, tech-forward abode, this guide will help you navigate the world of home construction loans with humor, style, and plenty of expert tips.

Best Home Construction Loans in 2025 Table of Contents

Understanding Home Construction Loans: The Building Blocks

Types of Home Construction Loans: Tailor-Made Financing for Every Dream

Why 2025 Is the Year for Home Construction Loans

The Home Construction Loan Process: A Blueprint for Success

Navigating the Market: Tips for Comparing Rates and Terms

Case Studies: Real-Life Success Stories in Home Construction Financing

Resources and Community Support: Your Next Steps

Tech Trends Impacting Home Construction Loans in 2025

Building Your Strategy: A Personalized Home Construction Loan Plan

Integrating Sustainable Practices into Your Home Build

Frequently Asked Questions About Home Construction Loans in 2025

Your Financial Blueprint for the Future: Embrace Your Home Construction Journey

Understanding Home Construction Loans: The Building Blocks

Home construction loans are a specialized type of financing designed to help you fund the construction of your new home. Unlike traditional mortgages—which are designed for purchasing pre-built properties—construction loans provide the funding needed to cover the building costs, from materials and labor to permits and unexpected expenses. Think of these loans as the financial foundation upon which your dream home is erected.

At its core, a home construction loan is a short-term, variable-rate loan that provides you with the capital for building your home. Once construction is complete, many lenders offer construction-to-permanent options where the initial loan converts to a long-term mortgage at a predetermined interest rate. This dual phase is essential if you want a seamless transition from building to living in your new space.

In 2025, innovations in digital banking and construction technology have made the home construction loan process more transparent and accessible than ever. Lenders now provide robust online tools and mobile apps that allow you to track your project's progress, monitor disbursements, and even access personalized financial advice right from your smartphone.

Types of Home Construction Loans: Tailor-Made Financing for Every Dream

Not all construction loans are created equal. Depending on your project, income, and long-term plans, you have several options to choose from. Here are the most common types of home construction loans available in 2025:

1. Construction-to-Permanent Loans

Construction-to-permanent loans are the most popular choice for many aspiring homeowners. With this loan, you initially finance your home construction with a short-term loan. Once construction is completed, the loan converts into a permanent mortgage with a fixed interest rate. This type of financing reduces the hassle of applying for a new mortgage post-construction and streamlines your financial planning.

2. Standalone Construction Loans

A standalone construction loan is ideal if you prefer to secure separate financing for the building phase and then shop around for a long-term mortgage afterward. While these may offer more flexibility in choosing your future long-term rates, they generally require a second closing process and can present additional paperwork.

3. Renovation Construction Loans

Not all construction projects are about building from scratch—many involve significant renovations. Renovation construction loans are designed to cover extensive remodeling projects, such as transforming a historic home into a modern paradise or adding a tech-savvy living space to an older property. These loans consider the future value of the improved home and often come with guidelines tailored for renovation expenses.

4. Owner-Builder Loans

If you’re the kind of person who loves rolling up your sleeves and managing the construction process yourself, an owner-builder loan might be perfect. However, be prepared: lenders usually impose stricter approval criteria if you’re acting as your own general contractor, including proof of construction expertise and a detailed building plan.

These diverse options mean that regardless of whether you’re planning a sustainable tiny house, a sprawling suburban retreat, or a smart home fit for the future, there’s a construction loan program tailored to meet your specific needs.

Why 2025 Is the Year for Home Construction Loans

The real estate landscape in 2025 is buzzing with fresh opportunities and innovative financing models. Here’s why this year is a game-changer for home construction loans:

- Tech-Enhanced Lending: Digital platforms streamline the application process, offer real-time updates, and empower you to make informed decisions from anywhere in the world.

- Flexible Loan Terms: With a widening variety of loan products designed to suit different financial profiles, more people have the chance to invest in their dream homes.

- Competitive Rates amidst Market Innovation: Economic innovations and increased competition among lenders have led to more favorable interest rates and terms that can make home construction loans more affordable.

- Environmental & Sustainability Goals: Many lenders now offer special programs for eco-friendly construction, including incentives for using renewable energy sources and sustainable materials.

The blend of cutting-edge technology, innovative loan products, and a focus on sustainability makes 2025 an exciting time to embark on a home construction journey. In a world where every dollar and every design choice counts, choosing the right financing option can bring you one step closer to a responsible, modern lifestyle.

The Home Construction Loan Process: A Blueprint for Success

Understanding how home construction loans work is the first step towards making confident financial decisions. Here’s a step-by-step guide to the process that will help you break down barriers and keep your stress levels low (and your humor high!):

Step 1: Pre-Approval and Planning

Before you even pick out color schemes and smart appliances, start with a thorough pre-approval process. This involves a financial check-up including income, credit score, debt-to-income ratio, and a solid construction plan. Pre-approval gives you a realistic idea of your budget and ensures that lenders take you seriously.

Alongside pre-approval, draft a detailed construction plan with your architect and builder. This plan should outline everything from timelines and budgets to design specifics and contingency plans. Detailed planning shows lenders that you’re well-prepared while minimizing the risks that come with unexpected costs or delays.

Step 2: Loan Application and Documentation

The actual application process can feel overwhelming—like assembling IKEA furniture without the manual—but a bit of organization can go a long way. Prepare all necessary documentation, including:

- Proof of income and employment (tax returns, pay stubs, etc.)

- Credit reports and personal financial statements

- A complete building plan from licensed professionals

- Cost estimates, including materials, labor, and permits

- Detailed timeline and milestones for the construction process

Many contemporary lenders offer online portals where you can securely upload documents, track application status, and even chat with a financial advisor in real-time—making the process smooth and, dare we say, even enjoyable.

Step 3: Funding Disbursement During Construction

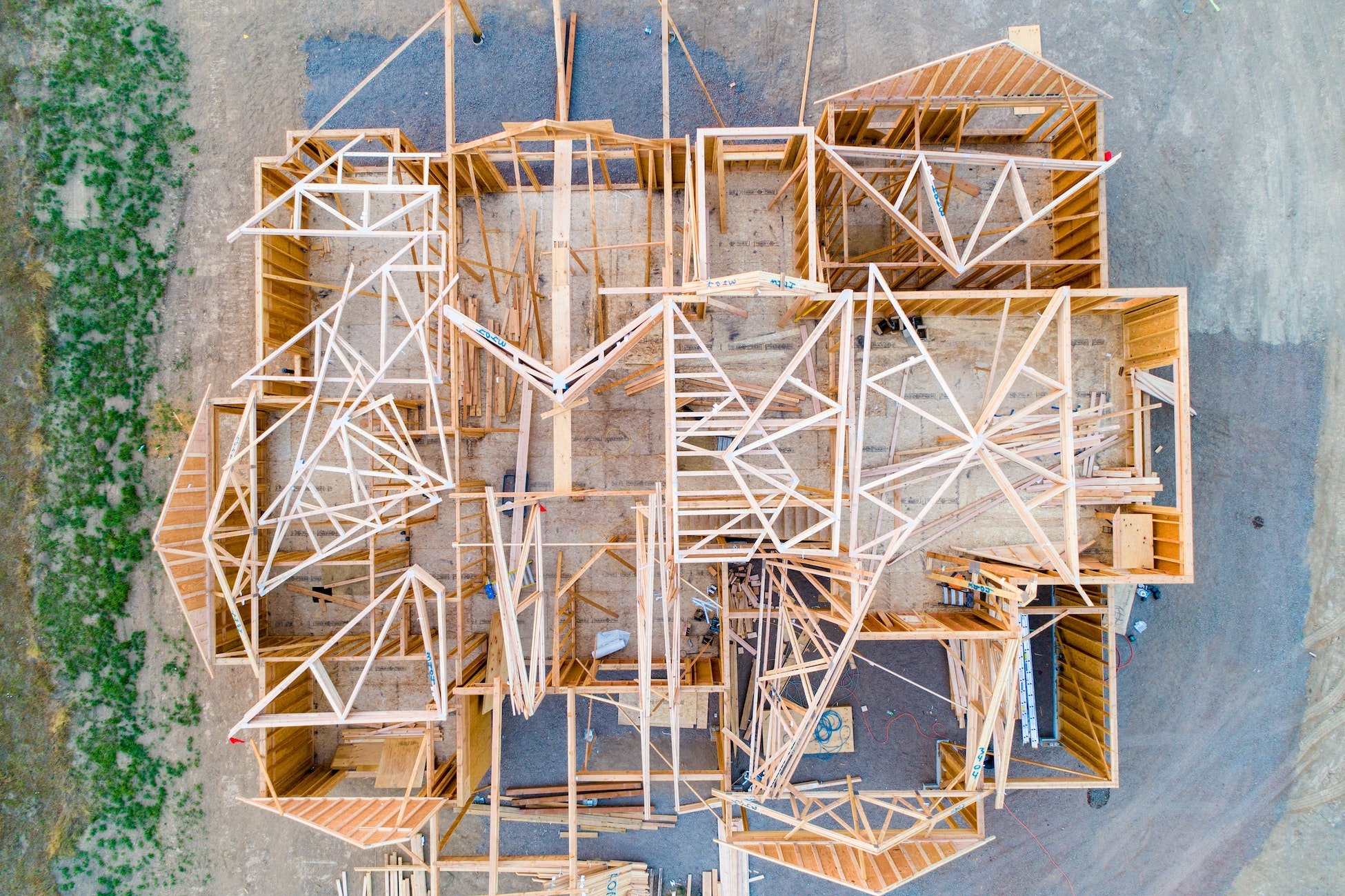

Once your loan is approved, the funding process kicks off. Unlike traditional mortgages that provide a lump sum, construction loans are disbursed in stages, known as draws. Each draw corresponds to a phase of the construction (e.g., foundation work, framing, roofing, finishing touches), ensuring that funds are allocated as the project progresses.

Lenders or third-party inspectors will usually evaluate the work completed before releasing the next draw. This staged approach protects both you and the lender by ensuring that funds are spent effectively and that the construction remains on track.

Step 4: Conversion to a Permanent Mortgage

After your home is built to perfection (or perfection-adjacent), it’s time to convert your short-term construction loan into a permanent mortgage. Many lenders facilitate a seamless transition through construction-to-permanent loans. The conversion locks in your interest rate and begins your journey as a homeowner.

It’s critical during this phase to review all terms carefully—ensuring there are no hidden fees and the conversion meets your long-term financial goals. With plenty of digital tools available, comparing rates and terms has never been easier.

Navigating the Market: Tips for Comparing Rates and Terms

In the world of home construction loans, rate comparisons and flexible terms are essential. With so many options on the market, how do you ensure you're getting the best deal possible? Here are some seasoned (and slightly sassy) tips to help you make an informed decision:

Do Your Homework

The first rule of thumb: never settle for the first offer. Do your research across multiple lenders—banks, credit unions, and even online financial institutions—and compare interest rates, fees, and terms. Utilize digital tools and loan calculators to simulate potential loan outcomes based on your building plan.

Understand Variable vs. Fixed Rates

Home construction loans often come with variable interest rates, meaning your rate can adjust over time based on market conditions. However, some lenders now offer fixed-rate options, or at least a fixed convertibility after construction. Evaluate your risk tolerance—if you prefer predictable payments, a fixed rate might be worth the extra upfront cost.

Look for Hidden Fees and Flexibility

Always read the fine print. Some loans offer competitive rates but come with application fees, transaction fees for each draw, or penalties for construction overruns. Negotiate these fees, and consider loan products that offer built-in flexibility for unexpected expenses—a little cushion can be a lifesaver when dealing with unforeseen setbacks on site.

Consult with Financial Experts

In an era where financial advice is just a click away, leverage the expertise of financial advisors and mortgage brokers. They can provide personalized insights into market trends, ensuring that the loan you choose aligns with both your construction blueprint and your long-term financial goals.

With these tips, you can confidently compare home construction loans, ensuring that your financing is as solid as the foundation of your future home.

Expert Strategies from Financial Gurus: Making Inflation, Market Fluctuations, and Loan Jargon Your Friends

Let’s be honest: the world of construction financing can sometimes feel like you need a PhD in financial wizardry to decipher it. But don’t worry—our team of financial gurus has gathered some strategies that not only demystify the process but also put you in the driver’s seat.

Lock It In Early

With the economy in flux and interest rates potentially on the move, one strategy is to secure a favorable rate early in the process. Many lenders will allow you to lock in a rate once your construction plan is approved—this means you can hedge against market fluctuations and sleep a bit easier knowing your future payments are predictable.

Embrace the Digital Revolution

Gone are the days of endless paperwork and snail-mail approvals. In 2025, the financing landscape is driven by digital innovation. Use online mortgage platforms, mobile apps, and even AI-powered financial advisors who can help simulate various scenarios. These tools not only quicken the process but also make it interactive and engaging—ideal for the tech-savvy generation.

Plan for the Unexpected

Construction is famously unpredictable—think of it as the ultimate DIY challenge where every day presents a new plot twist. Build a contingency fund into your loan requirements and budget. This forward-thinking strategy ensures that whether there’s a delay in material delivery or a creative design change mid-build, you’re financially ready for it.

Stay Informed with Market Trends

Keep an eye on construction trends, property values, and new financing incentives that may be offered by state or local governments. A little research can go a long way in matching your home construction loan with programs that offer rebates, tax incentives, or green-home credits.

With these strategies in your toolkit, you’re not just applying for a home construction loan—you're turning the finance process into an empowering experience that sets the stage for a lifetime of smart, secure investments.

Case Studies: Real-Life Success Stories in Home Construction Financing

Sometimes the best inspiration comes from real people who have been there, done that, and are now kicking back in their custom-built abodes. Here are a few case studies illustrating how embracing modern home construction loans can lead to successful, stress-free builds:

Case Study 1: The Sustainable Starter Home

Meet Emma, a first-time homeowner in her early 30s who dreamt of building an eco-friendly smart home in the suburbs. Emma decided on a construction-to-permanent loan that offered competitive renewable rates. By leveraging state incentives for sustainability and collaborating with a local green building contractor, she was able to lock in a low interest rate and even include energy-efficient upgrades. Her online loan management dashboard kept her informed every step of the way. Today, Emma’s home runs on solar power and features a rainwater harvesting system—all thanks to a loan product that was as innovative as her design.

Case Study 2: The Renovation Renaissance

Carlos, a tech entrepreneur and self-proclaimed “renovation renegade,” was determined to transform his 1920s bungalow into a modern, tech-integrated haven. He opted for a renovation construction loan that allowed him to cover the costs of high-tech installations, custom smart systems, and even a quirky indoor garden. Through meticulous planning and digital budgeting tools, Carlos managed to secure a favorable rate that accommodated his unique project requirements. His successful transformation became a local buzz—showing that with the right financing, you can blend historic charm with modern innovation.

Case Study 3: The Owner-Builder Revolution

Finally, consider Ryan, a DIY enthusiast with a passion for design and a knack for project management. Ryan took the plunge with an owner-builder loan, despite the stricter requirements, and managed the construction of his dream off-grid cabin entirely on his own. By harnessing online resources, forums, and step-by-step construction planning apps, he was able to navigate the complexities and secure a loan that rewarded his attention to detail. Today, Ryan’s unique abode serves as a retreat for his creative friends—a testament to the power of determination, innovation, and the right loan product.

These case studies are proof that whether you’re embarking on a green home project, renovating a legacy property, or managing an owner-build, the right construction loan can turn visions into reality with a dash of modern flair and a pinch of financial savvy.

Resources and Community Support: Your Next Steps

Financial decisions shouldn’t be made in isolation. As you consider the best home construction loans in 2025, tapping into resources and building a supportive network is key. Modern digital platforms offer a wealth of information, from interactive calculators and budgeting tools to online communities and expert webinars that demystify construction financing.

Check out local and online forums where fellow home builders share their experiences, tips, and even trade recommendations for trusted contractors and architects. Many lenders also provide community-driven resources, including virtual workshops and Q&A sessions with industry experts. These initiatives empower you to ask questions, gather insights, and ultimately make decisions that align with your financial aspirations and design dreams.

Additionally, explore government and non-profit programs aimed at supporting sustainable and affordable home construction. In 2025, more financial institutions are partnering with community organizations to offer grants, tax credits, and other incentives that can reduce the financial burden and accelerate your path to homeownership.

Your journey to building a modern, tech-friendly, and sustainable home is a collaborative process. By harnessing the power of community support and leveraging innovative financial tools, you not only secure the best home construction loan but also lay the foundation for a lifestyle that values financial well-being, cutting-edge technology, and environmental responsibility.

Tech Trends Impacting Home Construction Loans in 2025

The home construction loan ecosystem is evolving, thanks to advancements in technology and a shift in consumer expectations. In 2025, lenders are more transparent, accessible, and innovative than ever before. Here are some tech trends that are shaping the way you secure construction loans:

Artificial Intelligence and Machine Learning

AI-driven tools are now used to streamline the pre-approval process, analyze risk, and even suggest personalized loan packages based on your financial profile and construction plans. By leveraging machine learning, these platforms are able to predict market trends and help you lock in rates that work best for your long-term goals.

Blockchain for Transparency

Blockchain technology is making waves by ensuring that every step of the loan process is transparent and secure. From verifying your documents to tracking each disbursement during construction, the decentralized ledger system provides peace of mind and helps reduce fraud or mismanagement of funds.

Mobile Apps and Digital Dashboards

Imagine managing your construction loan like you would manage your favorite social media app—intuitive interfaces, live updates, and seamless communication with your lender. Modern digital dashboards allow you to monitor progress, communicate with your financial advisor, and even coordinate with your builder, all from the comfort of your smartphone.

Whether you’re tech-challenged or a digital native, these upcoming trends are democratizing home construction financing, ensuring that the process is as innovative and forward-thinking as the homes you aspire to build.

Building Your Strategy: A Personalized Home Construction Loan Plan

Crafting a personalized plan for securing a home construction loan requires some introspection, research, and a dash of creative ambition. Here’s how to create a strategy that works for you:

Step 1: Evaluate Your Financial Health

Start by assessing your current financial situation: review your credit score, income stability, savings, and any existing debts. Understanding your financial baseline is crucial for determining what type of construction loan products you qualify for and how much funding you’ll need.

Step 2: Define Your Home Vision

Whether you envision a cozy eco-friendly cottage or a sprawling smart home with the latest tech integrations, your project details will impact your loan requirements. Document every detail—from square footage and custom features to sustainability practices. This blueprint not only excites lenders but also clarifies your own budgetary needs.

Step 3: Research Lenders and Loan Products

With a clear plan in hand, dive into researching various lenders. Compare construction-to-permanent loans, standalone construction loans, and renovation loans. Pay attention to interest rates, fee structures, funding timelines, and customer reviews. Don’t hesitate to get advice from a financial advisor who understands the dynamics of modern construction loans.

Step 4: Assemble Your Dream Team

A successful construction project relies on the synergy between you, your lender, and your construction professionals. Assemble a team that includes an experienced lender, a forward-thinking architect, trusted contractors, and a financial advisor who can help integrate your construction loan into a long-term financial strategy.

Step 5: Embrace Flexibility and Monitor Progress

Construction projects are as dynamic as life itself—be prepared for changes in design, cost fluctuations, and unexpected hurdles. Ensure that your loan product includes provisions for additional draws or contingency funds, and make use of digital tools to monitor progress. Regular check-ins with your team will allow you to adjust your strategy as necessary and keep the project on track.

By tailoring your approach and remaining flexible throughout the process, you create a roadmap that transforms a complex loan application into a manageable, empowering journey towards building your dream home.

Integrating Sustainable Practices into Your Home Build

In 2025, sustainability isn’t just a buzzword—it's a way of life, and it plays a significant role in how home construction loans are structured. More lenders are rewarding environmentally conscious building practices by offering incentives or reduced interest rates for projects that incorporate sustainable materials, energy-efficient designs, and renewable energy solutions.

Consider incorporating elements such as solar panels, green roofs, energy-efficient windows, and water conservation systems. These choices not only reduce your carbon footprint but can also add long-term value to your property. Some lenders partner with local governments to provide tax breaks and credits for eco-friendly constructions, further sweetening the deal.

Whether you’re a passionate advocate for green living or simply looking to lower your utility bills, integrating sustainable practices into your home build can positively impact both your environment and your finances.

Frequently Asked Questions About Home Construction Loans in 2025

Below are some common questions that arise when exploring construction loans, along with insightful answers to help you understand the landscape better:

1. What is a home construction loan?

A home construction loan is a short-term, typically variable-rate loan used to finance the construction of a new home or a major renovation. Once construction is complete, this loan is often converted into a permanent mortgage.

2. How do construction-to-permanent loans work?

In a construction-to-permanent loan, the borrower receives a short-term loan to cover the building phase. After completion, the loan converts to a long-term mortgage, locking in a fixed rate or a new variable rate based on the lender’s evaluation.

3. Can I renovate an existing home with a construction loan?

Yes, renovation construction loans are specifically designed for extensive home remodels and renovations, offering flexible funding options that consider the future value of the improved property.

4. How are funds disbursed during construction?

Funds are released in stages or draws, corresponding to different phases of the construction process. Inspectors typically verify that work has been completed before approving each draw.

5. What factors do lenders consider when approving a construction loan?

Lenders evaluate your credit score, income stability, a detailed building plan with cost estimates, and your overall financial health. A pre-approval process helps determine your budget and improves your chances of securing the best loan terms.

6. Are there incentives for sustainable home construction?

Absolutely. Many lenders offer incentives such as reduced interest rates or special loan programs for eco-friendly projects that incorporate sustainable materials and energy-efficient systems.

7. How long does the construction loan process take?

The process varies based on the complexity of the project and the lender’s requirements. Typically, once approved, construction loans are disbursed over several months during the building phases, with a conversion process that begins once construction is complete.

8. Can I manage the construction loan process online?

Yes, many lenders provide digital platforms and mobile apps that allow you to manage your account, upload documents, monitor draw requests, and communicate with your lender in real-time.

Your Financial Blueprint for the Future: Embrace Your Home Construction Journey

Embarking on the path to build your dream home with a construction loan is as exhilarating as it is challenging. Every step, from pre-approval to choosing the right lender to navigating digital platforms, is an opportunity to tailor a financial plan that suits your lifestyle and goals.

In 2025, the world of home construction lending has evolved to become more transparent, flexible, and aligned with modern lifestyles. With technology at your fingertips and an array of loan products designed to meet diverse needs, you have everything you need to make a smart, informed decision.

Remember, your journey is uniquely yours. Whether you're a first-time builder dreaming of an eco-friendly sanctuary or a seasoned DIY enthusiast ready to orchestrate a modern masterpiece, every decision you make adds a brick to the foundation of your future. Embrace the process with confidence, stay curious, and make choices that honor your financial well-being while actualizing your vision.

From tech-driven applications to sustainable building practices and community support, the blueprint for success is clear. Your dream home is not just a structure—it's a reflection of your values, creativity, and determination. So go ahead: harness the power of modern home construction loans, build with purpose, and watch as your dream space transforms into a vibrant reality.

The future of home construction is bright, dynamic, and tailored for those who dare to dream big while making smart financial choices. Your journey to the best home construction loans in 2025 begins now—let it be a journey of empowerment, creativity, and growth.